eToro Cryptocurrency Exchanges Review

Best Exchange for Social Traders

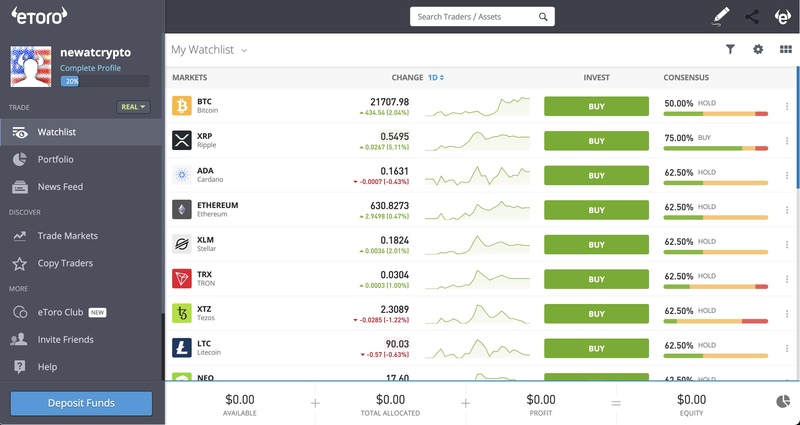

eToro is an exchange used by millions of traders worldwide, not only for crypto but also for various commodities, foreign exchange, exchange-traded funds, and equities. Their interface is graphical and user-friendly, and the push-button aesthetic allows users to buy, sell, and trade without worrying over technicalities.

The exchange offers 15 cryptos to choose from: Bitcoin, Ethereum, Bitcoin Cash, Ripple, Dash, Litecoin, Ethereum Classic, Cardano, IOTA, Stellar, EOS, NEO, TRON, Zcash, and Tezos. eToro also has what they call social trading, in which users can copy trades from other users. The exchange claims more than 13 million users across 140 countries.

Screenshot of a test profile on the eToro exchange - 12/16/20

The exchange provides a digital wallet and a virtual portfolio demo, a research sidebar that “aggregates the cumulative knowledge of traders and experts from some of the world’s leading financial institutions,” and has a stop-loss/take-profit feature that closes one’s position once it hits a certain loss and locks in profit once it hits a certain high, respectively.

Also, eToro offers advanced charting for technical analysis purposes, as well as what they call trailing stop loss, which keeps position open as long as markets are moving in desired direction. Customizable watch lists can send volatility alerts to your phone, and users can even trade offline. The exchange includes an education tab with information about what cryptocurrencies are, specifically Ripple and Ethereum, which are not quite as renowned as Bitcoin.

PRICING

The fee structure ranges from .75% to 2.9% depending on type of crypto. The crypto-to-crypto conversion fee is .1%, while crypto-to-fiat conversion is 5%. The exchange can only hold cash in USD. There is a fee for inactivity, as well, and a $5 withdrawal fee. Only one base currency is currently allowed. Regular trades require a minimum of $50, and a minimum deposit of $200 for the social trader.

TRUSTWORTHINESS

eToro operates according the regulations of the Cyprus Securities and Exchange Commission (CySEC). Clients in the UK are under Financial Conduct Authority (FCA) regulation, and Australian clients are under Australian Securities and Investment Commission (ASIC) rules.

Our Comments Policy | How to Write an Effective Comment

- Offers 14 popular cryptocurrencies

- Practice with a $100,000 virtual portfolio

- Copy top cryptocurrency traders

- User-friendly mobile apps

- Transparent pricing