Online Financial Advisors

of 2025

Advisor.com Financial Advisors Review

SERVICES

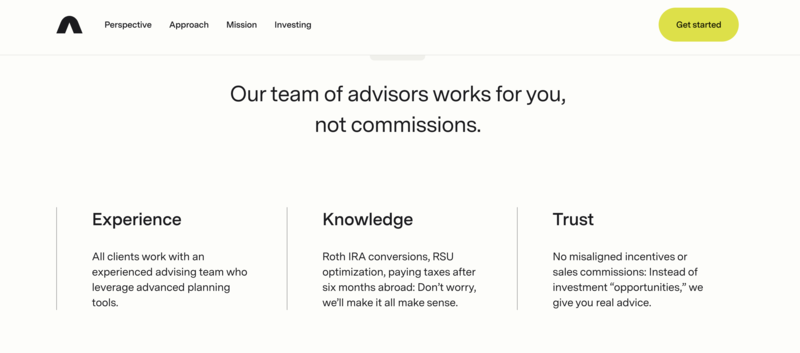

Advisor.com combines human expertise with automated technology. You have access to a dedicated financial advisor who provides personalized guidance, while the platform utilizes technology to streamline portfolio management and financial planning tools.

Here are some of the main services offered by Advisor.com:

-

Investment Management: Advisor.com invests your assets in a diversified portfolio of exchange-traded funds (ETFs). Advisor.com focuses on building customized portfolios based on your individual risk tolerance, investment goals, and financial situation. They emphasize evidence-based investment strategies and avoid promoting custom portfolios, which they believe can be expensive and ineffective. You can choose to have Advisor.com directly manage your investments through their affiliated custodian or opt for advisory services where they guide you on managing your investments through your preferred broker or platform.

-

Goal Planning: The platform offers tools to visualize your financial goals, test different economic scenarios, and complete tasks to increase your chances of achieving them.

-

Holistic Financial View: Advisor.com goes beyond traditional investment management. They provide tools to track all your assets and liabilities, including investments, bank accounts, and debt. This allows you to gain a comprehensive understanding of your overall financial health.

-

Additional Resources: The platform offers educational resources and guidance on various financial topics, including debt management, budgeting, insurance analysis, and tax estimations.

FEE STRUCTURE

Advisor.com offers two fee structures:

-

Flat Fee: Advisor.com offers financial planning services for a flat annual fee of $3,750. This is regardless of your assets under management (AUM), which is a contrast to traditional financial advisors who typically charge a percentage of your AUM.

-

AUM (Assets Under Management) Fee: Households with greater than $1 million in financial assets are eligible for the ccompany's AUM fee structure. This plan charges an annual fee based on a percentage of your total invested assets. The fee starts at 0.50% and decreases as your assets increase, potentially making it more cost-effective for individuals with larger portfolios.

Our Comments Policy | How to Write an Effective Comment

Advisory fee starting as low as 0.30%*

- Advisors help with tailored planning to fit your unique goals

- Start your advisor journey with just $50,000

- Clear and transparent communication about fees