- Monthly premiums as low as $10

- Ages 18 to 60 are eligible to apply

- Term life policies $50,000-$1.5 million in coverage

- Company offers 10, 15, 20, 25, and 30-year terms

- Apply online for affordable term life insurance

- Featured in WSJ, CNN, Forbes, TechCrunch & Money.com

Federal Trust Life Insurance Review

ConsumersAdvocate.org

Federal Trust Life Insurance - Overview

With the ability to compare policies from almost 50 of the most well-respected life insurance carriers in the world, Federal Trust Life may be relatively new to the life insurance business, but they are making themselves known fast.

The company allows you to compare policies from Prudential, John Hancock, US Life, and Protective Life among others. This is all done through a quick, no-nonsense online process that can be completed in minutes.

Customers of Federal Trust can input minimal information, answer a few questions, and have quotes from some of the most trusted financial institutions fast. If that wasn't enough, you can complete the entire online application process with Docusign!

This wide net of global, national, and local carriers provides an almost limitless variety of policies and policy options that fit every conceivable need.

Federal Trust Online Portal

Company Reputation

Federal Trust offers life insurance policies from rock-solid industry leaders, as well as smaller local entities. Choosing the best option all depends on your personal and financial situation.

Many of the carriers Federal Trust works with have great reputations in terms of creditworthiness and claims paying ability, and have been around for a very long time.

Below is an example of the financial strength ratings of selected companies you might receive quotes from through Federal Trust:

Financial Strength Ratings (FSR)

|

|

Prudential |

John Hancock |

US Life |

Protective Life |

|

Standard and Poor’s |

AA- |

AA- |

A+ |

AA- |

|

Moody’s Rating |

A1 |

A1 |

A2 |

A2 |

|

A.M. Best FSR |

A+ |

A+ |

A |

A+ |

|

Fitch Ratings |

AA- |

AA- |

A+ |

A+ |

Policies

Federal Trust offers consumers a vast array of policies to choose from. Term length vary widely.

The company offers terms of 10-30 years, 20 and 30 year return of premium term, as well as policies that cover you to age 95, 100, and 120.

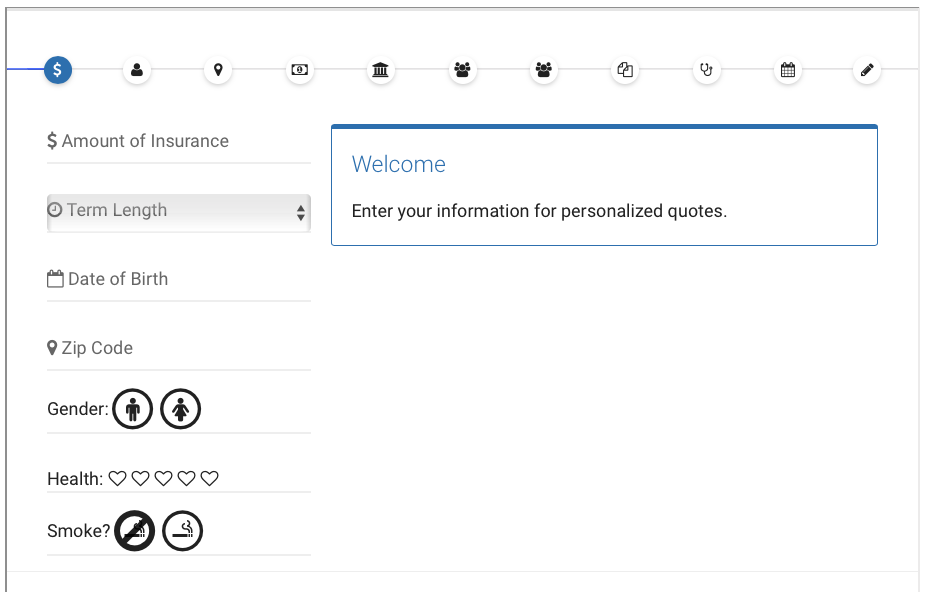

During the application process, you will be asked for the following information:

- Amount of Insurance

- Term length

- Date of Birth

- Zip Code

- Gender

- Health Assessment

- Smoke yes/no

Then you will be offered a convenient list of quotes from individual companies.

After you select a company, you will be prompted to provide further personal information and answer questions.

The process only takes a couple of minutes.

Sample Life Insurance Policy from Federal Trust

|

Prudential Term Essential |

|

|

Age |

18-65 |

|

Terms |

10, 15, 20, or 30 years |

|

Coverage Limits |

$100,000 - $10,000,000 |

|

Guaranteed level premiums |

Yes, for the initial term |

|

Affordable Coverage |

Yes |

|

Death Benefit |

Yes |

|

Medical Exam |

Yes |

Additional Features

Federal Trust features plans with useful riders and additional benefit options. These are designed so you can tailor your policy to best suit yourself and your family.

Some popular options include long-term care insurance, which covers the costs of caring for you if you become incapacitated and cannot work, disability waiver of premium, where you don't have to pay your monthly premium should you suffer a disability, and an accelerated death benefit, which allows you to receive cash advances from your policy should you have a terminal illness.

Some other common riders the company offers include:

Chronic care insurance

Accidental death benefit

Spouse's paid-up insurance

Child insurance

Insurance exchange

Dividend option terms

Help and Support

To find support services for policies offered through Federal Trust, you must consult the individual provider you ultimately select.

Support is generally provided normal business hours, and also through email and online chat.

Federal Trust Life Insurance – Final Thoughts

Federal Trust is a great option if you are looking to compare top-notch life insurance plans fast. The company can offer you access to policies and quotes you would usually have to go through each individual company's quote process to obtain.

This would often mean having to negotiate with agents and other salespeople.

With Federal Trust, you can circumnavigate the entire process and compare the most up to date quotes from the best carriers in real time. All-in-all, great flexibility, and a quick process make Federal Trust a great choice.

Our Comments Policy | How to Write an Effective Comment

- Monthly premiums as low as $10

- Ages 18 to 60 are eligible to apply

- Term life policies $50,000-$1.5 million in coverage

- Company offers 10, 15, 20, 25, and 30-year terms

- Apply online for affordable term life insurance

- Featured in WSJ, CNN, Forbes, TechCrunch & Money.com