Humana Medicare Advantage Insurance Review

Plan Types

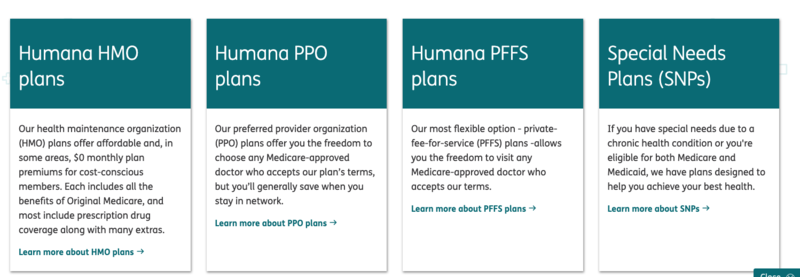

Humana offers the two most common types of Medicare Advantage plans -- health maintenance organization (HMO) plans and preferred provider organization (PPO) plans -- as well as special needs plans (SNPs) for those with chronic health conditions or those eligible for both Medicare and Medicaid. It doesn't offer point of service (POS) plans, which are a combination of HMO and PPO plans, but it does offer private-fee-for-service (PFFS) plans. These are relatively rare and more flexible than most Medicare Advantage plans. They enable you to visit virtually any doctor or hospital that accepts Medicare, so they're a great choice for seniors who travel often and don't want to be limited to a particular network.

Coverage

Humana's Medicare Advantage plans stand out by offering a variety of services that go beyond what Original Medicare offers. They include routine dental and vision coverage and prescription drug coverage, which are available with many of the top Medicare Advantage plan providers. There's also less-common options like routine transportation and hearing services. This includes coverage for hearing aids, a notable omission from Original Medicare.

Many of Humana's plans also include Silver Sneakers fitness coverage. This includes free access to over 15,000 gyms and fitness locations nationwide plus an online library of workout routines for those who prefer to exercise at home. Few other Medicare Advantage plan providers offer services like this, so Humana is worth considering if you're interested in maintaining a healthy, active lifestyle in your golden years. You can view all of the services each plan includes by clicking on its Details page.

Pricing

Humana has some of the largest ranges in terms of plan cost of any of the top Medicare Advantage plan providers. This is valuable because it makes it easier for seniors to find the best balance of cost, coverage and flexibility for their budgets. While some of its more flexible plans may cost upwards of $100 per month, there are also many options with a $0 premium and deductible. The premiums, deductibles, copays and maximum out-of-pocket costs are all listed on your main results page so you can quickly identify which options best fit your budget.

Once you've narrowed down your choices, you can compare up to three Medicare Advantage plans side by side to determine which offers the best coverage in relation to the cost. This saves you time switching back and forth between pages and it's a feature you only find with the top Medicare Advantage plan companies.

Customer Experience

Navigating Humana's website is easy for anyone who's pretty familiar with the internet. You just enter your ZIP code and you can see and compare all the Medicare Advantage plans available in your area. Once you find one you like, you just fill out some personal information and you can purchase your policy online. You can also contact a Humana agent by phone if you're more comfortable purchasing a plan this way.

Humana's customer satisfaction ratings with TrustPilot and the Better Business Bureau (BBB) are about on par with ratings for the other top health insurers in the nation. It came in third in J.D. Power's Medicare Advantage customer satisfaction survey, earning above-average ratings for billing and payment, information and communication, and overall cost. It received the highest score of the top five largest health insurers in the nation.

Financial Strength

Humana and all of its subsidiaries maintain relatively strong financial strength ratings with organizations like A.M. Best. This is essential for any Medicare Advantage plan provider because customers want to make sure that their insurer will be able to pay out their claims when necessary. Humana customers won't have to worry about this being an issue.

- Discover Affordable Medicare Plans

- Monthly Plan Premiums as Low as $0 in Most Areas

- Shop Online for Humana® Medicare Advantage Plans