10 Best Student Loan Refinance of 2026

selected this partner

selected this partner

🥇Our #1 Pick to Pay Less Every Month

- Lowest Rates - Rates from 4.24% fixed APR (with autopay)* and 3.69% Var. APR (with autopay) See Terms* 1

- Compare free personalized rates from multiple lenders in 2 minutes

- Get $200 if you can find a better rate2

- No origination or prepayment fees

- Checking rates won’t impact your credit score

Splash

- Rates starting at 4.20% APR4

- Best for excellent credit scores

- No refinancing or pre-payment penalties

ELFI

- Rates starting at 4.74% APR

- A loan advisor will guide you from start to finish

- Repayment terms of 5, 7, 10, 15, and 20 years

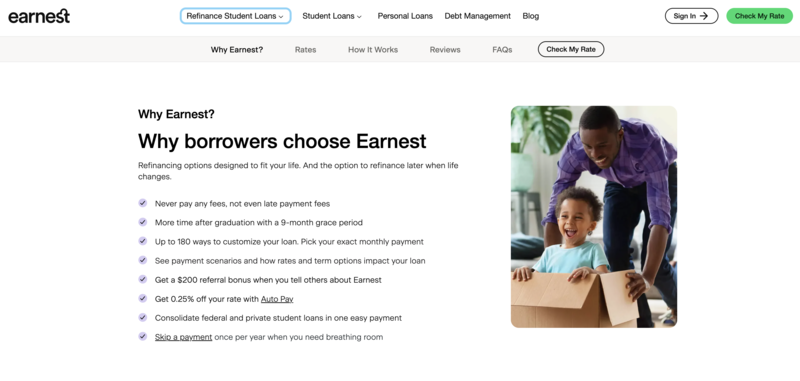

Earnest

- Rates starting at 4.15% APR5

- Rates based in part on your earning potential

- Skip 1 payment per year without penalties

selected this partner

selected this partner

🥇Our #1 Pick to Pay Less Every Month

- Lowest Rates - Rates from 4.24% fixed APR (with autopay)* and 3.69% Var. APR (with autopay) See Terms* 1

- Compare free personalized rates from multiple lenders in 2 minutes

- Get $200 if you can find a better rate2

- No origination or prepayment fees

- Checking rates won’t impact your credit score

Credible Student Loan Refinance

Credible Student Loan Refinancing Review:

Founded in 2012, Credible is a free, multi-lender marketplace that connects student and parent borrowers with leading student loan refinancing options. It helps borrowers find lower rates, especially if their credit has improved or they previously took out loans at higher rates. Partner lenders also offer consolidation of federal and private loans, potentially lowering interest rates. Checking rates won’t affect your credit score, and the entire process—from comparison to application—can be done online with the lender.

Rates and Terms:

The platform partners with leading lenders offering both fixed and variable rates. Loan terms range from 5 to 20 years, with rates as low as 3.69% APR fixed for qualified borrowers, including autopay discounts.

Eligibility:

Eligibility depends on the chosen lender, typically requiring good credit, stable income, and a completed degree. Some lenders accept co-signers to help improve approval odds.

Key Features:

Credible’s standout features include a user-friendly interface, personalized rate comparisons in under 2 minutes, and a rate-match guarantee. However, it’s worth noting that federal loan borrowers lose benefits like income-driven repayment plans if they refinance.

Who It’s Best For:

Credible is best for borrowers with strong credit or co-signers seeking competitive rates and a hassle-free comparison process. While it doesn’t refinance loans directly, its partnerships with reputable lenders make it a solid choice for saving time and money.

SoFi Student Loan Refinance

SoFi® is a leading online lender offering student loan refinancing with competitive rates and exclusive member benefits. Known for its streamlined process and financial perks, SoFi caters to borrowers seeking flexibility and support beyond refinancing.

Rates and Terms:

SoFi provides fixed and variable interest rates starting as low as 4.24% APR with autopay. Loan terms range from 5 to 20 years, allowing borrowers to tailor repayment plans to their needs.

Eligibility:

Applicants need a solid credit history, stable income, and an associate degree or higher. Co-signers can improve approval chances.

Who It’s Best For:

SoFi is ideal for borrowers with strong financial profiles looking for competitive rates and added perks. Its comprehensive benefits make it especially appealing for those seeking more than just lower interest rates. SoFi’s intuitive platform and top-notch customer support further enhance the refinancing experience, making it a great choice for borrowers prioritizing ease, value, and long-term support.

Splash Financial Student Loan Refinance

Founded in 2013, Splash Financial is a lending marketplace that offers borrowers a wide range of options. Offering both fixed- and variable-rate loans for customers with college and graduate school debt, the company can help you consolidate multiple loans, lower your monthly payments, and reduce the lifetime cost of borrowing. Splash is located in Cleveland, Ohio.

Splash Financial offers borrowers a wide range of student loan refinancing options, with a very easy-to-use online loan calculator and competitive interest rates. Splash student loan refinancing is for college graduates who are earning income. Loans are open to either the graduate or parent of the graduate with payment terms of 5, 7, 10, 12, 15, 20 or 25 years.

To refinance through Splash Financial, borrowers must be US citizens, permanent residents, or visa holders, have outstanding loans of at least $5,000, and have an associate, bachelor's, or graduate degree. In addition, borrowers must have proof of income from a current employer and a minimum credit score of 640.

After answering just a handful of questions, borrowers can quickly and easily learn the rates available to them with Splash Financial's online loan calculator.

ELFI Student Loan Refinance

ELFI Student Loan Refinancing Review:

Education Loan Finance (ELFI) is a top choice for borrowers seeking student loan refinancing with competitive rates and exceptional customer service. Backed by SouthEast Bank, ELFI offers a straightforward refinancing process and personalized support.

Rates and Terms:

ELFI provides fixed and variable interest rates starting as low as 4.48% APR with autopay. Loan terms range from 5 to 20 years, giving borrowers flexibility to choose a repayment plan that suits their needs.

Eligibility:

Applicants need a minimum credit score of 680, stable income, and a bachelor’s degree or higher. ELFI also allows co-signers to strengthen applications, making refinancing accessible to a wider range of borrowers.

Key Features:

ELFI stands out for its dedicated loan advisors, no fees for applications, origination, or prepayment, and an easy online application process. However, refinancing federal loans with ELFI eliminates access to federal repayment programs and protections.

Who It’s Best For:

ELFI is ideal for borrowers with strong credit or a reliable co-signer who want competitive rates, flexible terms, and personalized customer service. It’s a great fit for those seeking a straightforward, supportive refinancing experience.

Earnest Student Loan Refinance

Earnest Student Loan Refinancing Review:

Earnest offers student loan refinancing with customizable repayment options and competitive rates, making it a top choice for borrowers seeking flexibility. Earnest is known for its user-friendly platform and innovative tools to help borrowers manage their loans effectively.

Rates and Terms:

Earnest provides fixed and variable interest rates starting at 5.88% APR with autopay. Borrowers can choose loan terms ranging from 5 to 20 years, with the option to customize monthly payments based on their budget.

Eligibility:

Key Features:

Earnest features a seamless online application process, no fees for origination or prepayment, and the ability to skip one payment per year. However, refinancing federal loans forfeits access to federal benefits and protections.

Who It’s Best For:

Earnest is ideal for borrowers with strong financial profiles who value flexible repayment options and innovative tools. It’s a great choice for those seeking a personalized refinancing experience tailored to their financial goals.