Business Insurance

of 2025

- 100% dedicated to small business

- Insurance for dozens of business sectors from financial services to retail

- Eleven types of coverage available, including general liability, workers' comp, and liquor liability

- Get a fast, free quote online

- A+ rated by the Better Business Bureau

Acuity Business Insurance Review

Coverage

Acuity business insurance offers general liability, commercial auto, workers' compensation, property, excess liability and cyber crime policies. There's also a unique Bis-Pak option designed to provide total coverage to small business owners in a single, simplified policy. Tailor your coverage to your needs by adding optional protections made for your industry. For example, restaurant owners can add food spoilage coverage to protect them in case some of their inventory goes bad. Overall, Acuity's offerings are fairly comprehensive and on par with most other small to medium business insurers.

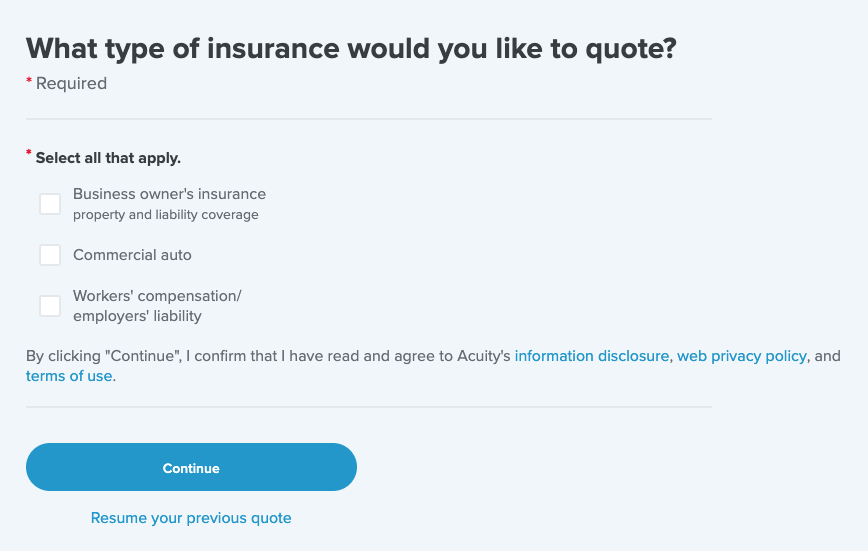

Quote Process

You can get an online quote directly from Acuity if you live in one the states it services. There's also a Find an Agent tool to help you locate an independent agent selling Acuity business insurance in your area. It can be useful to speak to an agent, especially if you're unsure of what coverages you need, but this approach also makes it difficult to price shop because you can't get any details about deductibles or premiums quickly. Your Acuity agent will have to reach out and ask you some questions. Then, they'll need time to get some quotes and call you back with the information.

Claims

You can file a claim using the online form on Acuity's website or by contacting the company by phone. A claims representative will usually get in touch with you within 24 hours to gather the facts. After that, you can track the claim's progress in your online account. Acuity doesn't share any information on the average claims processing time.

Customer Service

Because Acuity is sold through a network of independent agents, your customer service experience will vary depending on which agent you're working with. If you need immediate help and you are having trouble contacting your agent, you can reach out to the company directly by phone, email, or live chat during business hours.

Financial Strength

Acuity business insurance has received an A+ rating from A.M. Best and Standard & Poor's. This is a strong rating that suggests the company is more than capable of paying out claims when necessary, so you can feel confident that Acuity will be around for many years to come.

Bottom Line

Acuity's greatest downside is that it's not available in every state. But if you live in one of the 27 states that it serves, it's worth speaking to an independent agent to get a quote. Just know that it may take a while to get the information you need.

Our Comments Policy | How to Write an Effective Comment

- 100% dedicated to small business

- Insurance for dozens of business sectors from financial services to retail

- Eleven types of coverage available, including general liability, workers' comp, and liquor liability

- Get a fast, free quote online

- A+ rated by the Better Business Bureau