Best Homeowners Insurance

Based on In-Depth Reviews

- 400+Hours of research

- 34+Sources used

- 20+Companies vetted

- 6Research Criteria

- 9Top

Picks

- Make sure your home valuation report is up to date

- Consider full-replacement cost coverage if you live in a high-risk area

- Find out exactly what your policy covers before purchasing it

- Consider add-on coverages for flood & earthquake-prone areas

How We Analyzed the Best Homeowners Insurance Providers

Our Top Picks: Homeowners Insurance Reviews

Best homeowners insurance for older homes

Older homes come with a unique set of considerations, from outdated electrical systems to at-risk roofs. These risks can complicate your search for the best home insurance policy, as they typically result in higher premiums. This is where the wealth of discounts offered by Liberty Mutual comes in handy.

While most homeowners insurance companies offer discounts, Liberty Mutual stands out as offering some of the broadest and deepest discounts in the industry. Many consumers are likely to find that they qualify for more than one discount and will save significantly on their premium payments. These discounts can go a long way in helping to lower the overall cost of insuring an older home.

Broadly speaking, Liberty Mutual offers three categories of discounts:

- Personal discounts, which are based on actions you have (or haven’t) taken;

- Premises discounts, which are based on aspects of your home; and

- Policy discounts, which are based on aspects of your relationship with Liberty Mutual and the terms of the policy you choose

Not all discounts are available in all states, but the company’s online quote generator automatically applies all the discounts you qualify for to your premium estimate.

Available Discounts

Personal Discounts

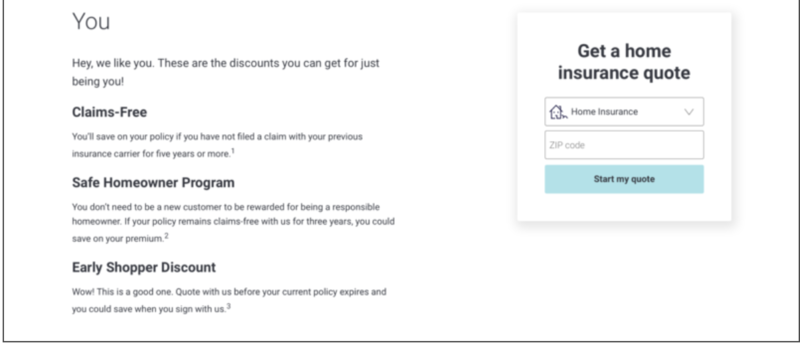

Liberty Mutual offers three personal discounts. Two of these are based on your claims experience either with your previous homeowners insurer or with Liberty Mutual. The third is a clever “early shopper” discount which may reward you if you apply for Liberty policy before your current policy terminates.

Screenshot of https://www.libertymutual.com/ 4/8/2020

Screenshot of https://www.libertymutual.com/ 4/8/2020

Premises Discounts

You may be entitled to a discount based on the age of your home, on the condition of its roof, and when you purchased the property. Newer and renovated homes and homes with new roofs are less expensive to insure, presumably because there is less risk of something occurring to them that could give rise to a claim.

Screenshot of https://www.libertymutual.com/ 4/8/2020

Screenshot of https://www.libertymutual.com/ 4/8/2020

Policy Discounts

As with most other multi-line insurance carriers, Liberty Mutual offers an auto-and-home bundle that is less expensive than the total of those policies purchased separately would be. This discount not only saves money, but also simplifies billing and the policy application process. There is also a discount available for people who insure the full replacement cost of their homes, rather than the market value. This opportunity is known as an insured-to-value discount https://www.insuranceopedia.com/definition/2435/insurance-to-value . Discounts in this category are also available for consumers who enroll in autopay and who agree to a “paperless policy” delivered electronically.

Screenshot of https://www.libertymutual.com/ 4/8/2020

Screenshot of https://www.libertymutual.com/ 4/8/2020

*Subject to eligibility requirements, and may vary by state. In some states, weather-related claims are not considered qualified claims in determining eligibility for this discount.

*Discount will vary by customer and are subject to policy deductible. Not available in Texas.

*Discounts and savings are available where state laws and regulations allow, and may vary by state. To the extent permitted by law, applicants are individually underwritten; not all applicants may qualify.

Financial Strength

When it comes to any long-term coverage, such as a homeowner’s policy, it’s generally a good idea to select a company that has been around for a long time and has continued to operate throughout a variety of economic circumstances. The firm that was later renamed Liberty Mutual was founded in 1912 and has remained in operation through two world wars, the Great Depression, and multiple recessions. This suggests that the company is well-managed and not likely to go under in tough times.

The ratings of the most respected industry analysts bear out this conclusion. It has “A” ratings from Standard & Poor’s and A.M. Best and an “A2” from Moody’s. These are very respectable, solid marks.

Consumers may also do well to consider Liberty Mutual’s size as an element of its financial strength. Generally speaking, larger carriers are better able to weather high claims experience brought on by localized disasters than local or regional insurers are. Liberty Mutual is the fifth largest property and casualty insurer in the US and has a homeowners insurance market share of 7.31%.

Policyholder Experience

In J.D. Power's 2022 U.S. Home Insurance Study, Liberty Mutual ranked below average in terms of overall customer satisfaction. However, J.D. Power's survey ranks insurers on a 1,000-point scale, and Liberty Mutual is only 44 points shy of the highest-ranking insurer (and a mere 14 points away from the average). This relatively negligible margin suggests that Liberty Mutual offers a policyholder experience on par with the best of its competitors.

Best homeowners insurance for first-time buyers

Allstate’s expansive educational content and resources, combined with its discounts for first-time home buyers and first-time Allstate policyholders (10%), make it ideal for new homeowners who might need more guidance or want to save hundreds on insurance each year. Allstate also offers discounts for bundled policies (up to 25%) and discounts for having no recent claims.

Tools & Quotes

One of Allstate's most useful customer support features is their Common and Costly Claims tool, which lets consumers check out the most common claims by zip code to get a better idea of their potential risks.

Allstate’s homeowners insurance policies offer the standard protection for the physical structure of the home as well as personal belongings and liability. Optional coverages include water backup, scheduled personal property, business property, identity theft restoration, and electronic data recovery, among others.

Homeowners can get free quotes using Allstate’s online shopping tool. Homeowners will also need to provide detailed personal information such as their driving record, home and auto insurance histories, whether or not they smoke, and whether or not they own a dog breed that's considered aggressive.

Screenshot allstate.com, August 2019.

Screenshot allstate.com, August 2019.

Financial Strength

As the nation's second-largest homeowners insurance company holding 9.02% of the current market share, Allstate continues to receive high ratings by all major credit rating agencies, including Standard & Poor's (AA-, among the best), A.M. Best (A+, Superior), and Moody’s (Aa3, not on watch).

A large market share can be a good indicator of a company's competitiveness and profitability, and may often translate into greater savings for consumers and a more diverse product offering.

Financial strength, on the other hand, confirms the company's financial ability to pay out claims after a widespread disaster, such as a hurricane or wildfire.

Large Network of Agents & Multiple Locations

Allstate gives consumers four different ways to file a claim: contacting an agent (in person service), by phone, using the company’s mobile app, or through its website.

One of Allstate’s biggest strengths is the number of professional agents they employ and the fact that they have locations in every state, which makes the process of getting in-person assistance easier.

Although they've received 3,245 customer complaints through the BBB over the last 3 years, it’s worth pointing out that this number is quite small considering they service about 16 million households. Allstate also takes the time to respond to reviews and complaints on their BBB profile, having closed out about half of those complaints over the last year. This is a sign of reliability and a customer-centric service philosophy.

The company scored a 0.74 on the 2022 NAIC Company Complaint Index, which is significantly lower than the national average of 1.00 and indicates a relatively low rate of consumer dissatisfaction when compared to other insurers.

Best homeowners insurance for veterans

The United Services Automobile Association (USAA) is another leading insurance provider offering highly-rated customer support from the initial quote to the claims process.

The company, which has been in operation since 1922, provides financial and investment services as well as insurance products exclusively to military service members and their direct families.

Despite its fixed customer base, USAA is deemed among the best insurance companies in the industry in terms of customer experience. According to the J.D. Power 2022 U.S. Property Claims Satisfaction Study, USAA earned the highest score out of the 17 eligible insurers included in the survey.

In addition, the company's 2022 NAIC Company Complaint Index score for homeowners insurance was 0.30. This is well below the industry average of 1.00, indicating that USAA earned far fewer complaints than expected when compared to other insurance companies.

Screenshot usaa.com, August 2019.

Homeowners Insurance Without Depreciation

One of the factors that set this company apart from the competition is that it offers a full replacement cost homeowners insurance policy that doesn't depreciate over time, and having a product that offers such protection means you don't have to pay out of pocket for expensive repairs.

USAA’s homeowners insurance policy protects against the most common perils, including fire, theft, vandalism, liability, identity theft, and most weather-related events. It also offers a discount for those who bundle their auto and home policies.

Another great detail about their homeowners insurance policy is that it provides full-value reimbursement for personal items, which also includes military uniforms for deployed or overseas servicemembers, without a deductible.

Strong Financial Ratings

USAA's property and casualty insurance segment holds some of the highest possible financial strength ratings in the industry with an A++ (Superior) from A.M. Best, an Aaa (Exceptional) from Moody's, and an AA+ (Very Strong) from Standard & Poor's. The company is also the fourth largest homeowners insurance provider in the nation, meaning that they are trusted by millions of policyholders.

Those wondering about the claims process through USAA should know the company offers different ways to file a claim, either by phone, online or through the mobile app. Policyholders who file claims online or through the app can do so 24 hours a day, 7 days a week, and a representative will be assigned to the case immediately.

USAA has proven itself to be a top-rated insurer with an excellent reputation, a comprehensive suite of products, and strong financials. Overall, this company appears to be a great fit for military servicemembers.

As mentioned before, homeowners interested in getting a quote from USAA must be military servicemembers or their direct families. Those who are eligible can easily apply for a quote online by entering their personal information, military connection, and social security number.

Best homeowners insurance for manufactured homes

Progressive is one the most well-known and established insurance companies in the U.S., offering a wide array of coverage options, especially for homeowners looking to insure their manufactured or mobile homes. All of Progressive's homeowners insurance policies include coverage for the structure, personal property, loss of use and personal liability.

Progressive also offers add-on options for replacement cost coverage, which pays to replace items without any depreciation, and a single deductible option for bundled auto and home insurance policies. This single deductible option allows customers to choose one deductible amount for both policies, resulting in a lower overall deductible when filing a claim for an event that causes damage to both your home and car.

One of the most unique add-on options available from Progressive is its trip collision coverage, which covers any damage that occurs to a mobile or manufactured home in the event of a collision when it's being moved. This coverage lasts for a period of up to 30 days, providing peace of mind when in the stressful process of relocating your entire home.

Large Number of Discounts

Another especially attractive aspect of Progressive's policy offerings is its large selection of discounts, which can save customers hundreds on their annual premiums. The following are some of the most common discounts available:

- Home & auto bundle discount

- Safety and alarm discounts

- Quote in advance (get a quote at least ten days before your policy starts)

- New purchase

- Receive documents by email

- New home construction

- Pay in full (paying for your 12-month policy upfront)

Screenshot Progressive.com, July 2023.

Screenshot Progressive.com, July 2023.

Financial Strength

Progressive holds 1.84% of the current homeowners insurance market share, making it the tenth-largest home insurance provider in the country. The company has a financial strength rating of A+ (Superior) from A.M Best, AA from Standard & Poor's, and Aa from Moody's. This puts Progressive near the top of the industry when it comes to financial strength and stability, allowing customers to rest easy knowing that the company is capable of meeting its long-term financial obligations.

Policyholder Experience

In J.D. Power's 2022 U.S. Home Insurance Study, Progressive made it into the top ten best insurers for policyholder experience, coming in at number ten. While this puts several other insurers ahead of them, it does show that their customer service and claims handling are generally satisfactory and still rank fairly high among the entire industry.

The company scored a 1.29 on the 2022 NAIC Company Complaint Index for homeowners insurance. This means that they have slightly more complaints than the national average of 1.00, indicating a relatively standard level of customer dissatisfaction when compared to other insurers.

Best homeowners insurance for condos

A general homeowners insurance policy needs to cover both the home itself, such as the structure and any attached fixtures, as well as outside areas, like a detached garage or shed. When it comes to condos, however, the coverage only needs to cover the inside of your unit. This is because the common areas and other parts of the structure, such as the roof and exterior walls, are already covered by a “master” policy that you share with the other unit owners. For this reason, it’s important to select a home insurance provider that offers specialized policies for condo coverage.

Lemonade offers homeowners, renters, and condo insurance policies to mostly urban residents. Its basic coverage includes dwelling, personal property, and liability protection and also protects your personal electronics, clothing, and furniture.

Additionally, the company offers scheduled personal property coverage, which means you can add valuable items like jewelry, fine art, musical instruments, and electronics to your policy, protecting them against theft, fire, or physical damage. There is even an option to add on equipment breakdown coverage, which is not usually included in standard homeowners coverage and can be a lifesaver if you need to repair or replace costly equipment like air conditioning, dishwashers, and other appliances.

Excellent Digital Experience

Lemonade is an insurtech company that only offers its services online and through its mobile app, which could be a fitting option for those looking to purchase insurance completely online without having to talk to an agent.

Something worth highlighting about Lemonade is that it donates its excess revenue from premiums to worthy causes identified by its policyholders. This program, Give Back, raised $1,873,588 in 2022, which went to 59 nonprofits.

Because it was originally certified as a Public Benefit Corporation by the third-party nonprofit B-Lab, Lemonade states it adheres to a higher standard of social and environmental accountability, as evidenced by the fact that they are fully paperless and one of the few environmentally-conscious insurance agencies in the market.

Screenshot lemonade.com, August 2019.

Screenshot lemonade.com, August 2019.

Competitive Premiums & Claims in 3 Seconds

Lemonade advertises rates as low as a $5 monthly premium for renters insurance and a $25 monthly payment for homeowners and condo insurance. Because it uses the latest technology to streamline the claims process, the company can offer low rates and donate excess premiums to charitable organizations.

Lemonade emphasizes that no claim is too small, which is a different approach from that of other insurance providers. The company states it approves claims in just seconds, and once filed on the company’s app, its AI runs 18 anti-fraud algorithms to approve the claim automatically and pay eligible claims almost instantly.

The company also says that 40% of filed claims are paid automatically. If the claim isn't approved immediately, it's handed over to Lemonade's team of agents for further evaluation.

Fully Automated Customer Service

Conducting business with Lemonade is done primarily through their multifunctional mobile application, which is available for Apple and Android devices. Its website offers a wealth of information regarding the company's processes and tools, including a quote calculator, and a customer service chat with AI.

Lemonade is a young company but already has demonstrated excellent customer service. In 2022, the company received a score of 1.04 on the NAIC Company Complaint Index. This means that Lemonade received an average amount of complaints when compared to other insurance companies.

Helpful information about Homeowners Insurance

Homeowners insurance is only a requirement if you're financing your home through a bank or lender, yet having a comprehensive policy for your house and personal items can afford you peace of mind, especially if you live in an area prone to natural disasters.

Having a good homeowners insurance policy isn't only for your home and belongings, however, as these products also feature a liability component that protects homeowners themselves against lawsuits from third parties injured on their property. This is why it's extremely important to only work with the best homeowners insurance companies.

What is homeowners insurance?

Homeowners insurance is a policy that helps protect the structure of your home, as well as any possessions you may have inside. It also includes liability coverage in case someone gets injured on your property. Your policy will usually cover damage from fires, storms, theft and more. Although homeowners insurance covers many types of severe weather and accidents, it usually doesn’t cover floods or earthquakes. If you live in an area prone to either of those disasters, you may need to purchase additional coverage.

Tips for Looking for Homeowners Insurance

Whether you're looking for the best homeowners insurance in Texas or the cheapest homeowners insurance in California, we've compiled several useful tips that will help you narrow down your search for the best homeowners insurance coverage.

Update Your Home Valuation

If your home is undervalued, your homeowners insurance policy won't cover 100% of the damages to it if the worst were to happen.

Similarly, if you've recently updated or renovated your house, your coverage amount should reflect those changes.

Keeping track of your home's value over time and updating your policy with each change will keep you fully covered and may even decrease your monthly payments if your updates have reduced risks and made your home safer.

Take inventory of your personal items

Since your belongings are also protected by your homeowners insurance policy, it pays to have an updated inventory of valuable items such as computers, cameras, sports equipment, and anything of significant value.

As the Insurance Information Institute points out, having an updated home inventory can help you get the right level of coverage, get your homeowners insurance claim settled faster, and help you verify losses for tax purposes.

Modify your homeowners insurance coverage based on risk factors in your area

If you live in an area prone to flooding, hurricanes, earthquakes, tornados, or wildfires, consider purchasing add-on or supplemental coverages that will provide full protection against these perils.

For homeowners in high-risk areas, we also recommend purchasing a full-replacement cost coverage that can provide sufficient funds to rebuild the home in the event of a total loss.

Know the factors that affect homeowners insurance rates

Many homeowners are unaware of the different factors that increase homeowners insurance rates.

Having a pool or trampoline, for example, will increase liability risks for your insurer, who will try to outweigh that risk by offering you a higher rate and monthly payment.

As we mentioned in the previous section, the pets you keep can also increase your homeowners insurance rates, especially if your pet is a larger dog that could harm another person or animal with a single bite.

Know what your homeowners insurance policy covers

The best way to avoid surprises when it's time to file a claim is by knowing everything that's covered under your policy right from the start.

Did you know, for example, that a renters policy covers items stolen from the policyholder's vehicle? Or that your liability protection covers accidents that happen to others visiting your property, whether inside or outside of your home?

Read the terms of your policy thoroughly and ask as many questions as you need before settling for an insurance provider and product.

Compare at least 3 homeowners insurance quotes before making a decision

Before choosing an insurance company and opting for a policy, make sure to compare all your options to get the best possible deal.

More than half of borrowers don't shop around before choosing a mortgage provider, and for many, homeowners insurance is just an unpleasant afterthought.

However, shopping around and becoming better informed about coverages and prices can help you get a better quote and save thousands of dollars in homeowners insurance over the life of your mortgage.

Only work with trusted homeowners insurance providers

Don't let a limited budget scare you into going for the first company that offers you a low rate.

There's a lot more to good homeowners insurance than a cheap price, like excellent customer service and strong financial backing.

Do business with reputable insurers that are accredited by organizations like the Better Business Bureau and have strong financial strength ratings from credit rating agencies like A.M. Best, Moody's, Fitch's, and Standard & Poor's.

How to lower homeowners insurance premiums

If your current homeowners insurance policy isn't meeting your needs or budget, there are a few easy ways you can reduce your insurance costs. These include:

- Installing security systems and smoke alarms

- Bundling policies with the same company (auto, home, life, etc)

- Inquiring about discounts

- Eliminating high-risk features (e.g. swimming pools, trampolines)

- Renovating or installing hurricane-resistant features in your home

- Shopping for better rates every few years

What To Watch Out for When Shopping for Homeowners Insurance

Natural disasters and being underinsured

During our research on homeowners insurance, we discovered that 60% of American homeowners are underinsured by an average of 17% of the cost of their homes.

We also learned that half of California wildfire survivors who owned a home were underinsured, and, in the case of Hurricane Harvey, 80% of survivors didn't carry flood insurance.

Most insurance companies will freeze homeowner policies when a natural disaster has occurred or prior to it happening. “In Louisiana, once a tropical storm or hurricane in the Gulf is officially named, insurance policies are frozen,” said Anne Shaffer, a Hurricane Katrina survivor and mortgage loan officer in the state.

There are contributing factors to why so many of us are underinsured and not know it, including:

-

The majority of homeowners will not experience loss or damage of their homes due to a natural disaster or from other causes, and therefore may never review their policy on a regular basis

-

Construction costs outpace inflation, so even if your insurance company adjusts for inflation, you may still be faced with a higher cost to rebuild your home than what you are covered for in your policy

Some of us think we are fully covered when we're not. Nick C., a survivor of Hurricane María in Puerto Rico, shared with us that his house sat flooded for 14 days.

“There was mold everywhere from the sitting water. All our furniture was ruined from the mold or the water.” - Nick C., Hurricane María survivorNick and his wife had purchased his homeowners and flood insurance policies through their mortgage lender at closing and weren't told what their policy covered. Because the process was so hurried and they were exhausted and ready to move into their new home, they never bothered to request their coverage details.

When Hurricane María hit Puerto Rico, Nick was safe with his family off-island and was able to file his claim immediately. He said it took at least a month before an adjuster could visit their home and then months before he and his wife were reimbursed for only about half of their out-of-pocket expenses and a quarter of the quoted damage.

Nick stated that, in hindsight, he would have looked into his policy details before signing up for the policies. Purchasing insurance through a financial institution after little or no research can be a gamble.

He also learned the value of good customer service in the wake of a disaster. If his insurance company had guided him through the process with patience and compassion, his experience would have been a lot different.

Rising homeowners insurance premiums

According to the NAIC annual report on insurance rates and trends based on 2015 data of the HO-3 homeowners insurance policy (the most common type), premiums have increased from 2007 to 2015 in every state, with some states seeing more significant increases.

The greatest cause of rate increases is attributed to bad weather including natural disasters such as tornadoes, floods, earthquakes, and hurricanes.

What can you do to make sure you are not underinsured or don’t have the right level of protection on your home and personal belongings? What we found during our deep dive on this topic is that many insurance companies and industry experts recommend you take the following steps to ensure you have the right coverage for your home and personal belongings:

Read your current policy in detail and, if needed, go through it carefully with your insurance agent or broker and make any necessary adjustments

Find out if you live in a flood-risk area and, if so, look into purchasing flood insurance

The same goes for areas prone to earthquakes and wildfires. Insurance companies have been steadily increasing premiums or dropping policyholders who live in high-risk areas. That makes the process of finding good coverage all the harder, but it's not impossible.

Remember, there are steps you can take to mitigate risk and lower your homeowners insurance premiums, like updating your home's systems and appliances, installing safety features like a home security system, sprinkler system or smoke and fire detectors, and doing away with features that could increase liability claims, like a trampoline.

Similarly, if you live in an area prone to hurricanes, storms or tornadoes, purchase storm shutters and consider floodgates for water damage mitigation. In areas prone to wildfires, maintain the vegetation around the house, keep combustible materials away from the main structure, and look into a fire-resistant siding.

Above all, consider your risks and prepare accordingly, taking the necessary steps to ensure the value of both your home and belongings is properly assessed and updated frequently.

More insight into our methodology

Coverage Options

Something to keep in mind about homeowners insurance is that there are plenty of policy types out there, but they can be classified according to how much protection they offer in terms of replacing your home and valuables after a covered loss, the perils they protect against, and the type of property they are designed for.

For example, homeowners insurance policies that provide actual cash value replacement take into account the depreciation of your belongings. That means that if you purchased an expensive appliance that was damaged due to an electrical surge and it's covered under your plan, having an actual cash value policy will give you the amount you paid for the appliance minus depreciation due to use.

Full replacement cost coverage, on the other hand, will provide you with the full amount you would need to replace the expensive appliance at today’s cost.

There is yet another type of coverage available, one that offers the greatest degree of protection: Guaranteed Replacement Cost Coverage. These types of policies provide the funds to rebuild a home after a total loss, even if that amount exceeds the coverage limits. They also protect homeowners from increases in the cost of building materials after a natural disaster, for example.

We spoke to licensed insurance expert Gilberto Sánchez about things to keep in mind when purchasing property and casualty insurance in the United States. According to him, the best way to determine your coverage needs is to talk to a licensed expert that can help you make an informed decision.

"Don't let your bank choose your homeowners insurance policy for you. A rule of thumb from a professional standpoint is to know the difference between policies in terms of what they cover, especially whether or not you're insuring your property for its actual cash value or its full replacement cost. While the first will take into account your property's depreciation, the second will not," said Sánchez.

The interactive tool below will help you narrow down your coverage needs based on the kind of home you own and the type of coverage each policy affords.

HO-1 (Basic Form)

The basic form only covers named perils and is the least expensive. It also tends to offer coverage for the main structure of the home or dwelling, but personal property and liability coverages have to be purchased separately.

Named perils typically covered under HO-1 policies include:

-

Fire & smoke

-

Explosions

-

Lightning

-

Hail & windstorms

-

Theft & vandalism

-

Damage from vehicles

-

Damage from aircraft

-

Riots and civil commotion

-

Volcanic eruptions

HO-2 (Broad Form)

Broad form policies typically offer protection for dwellings, other structures, personal belongings, as well as liability. They cover all the perils listed in the basic form, plus:

-

Falling objects

-

The weight of ice, snow, or sleet

-

The freezing of household systems (heaters & AC units)

-

Sudden and accidental damage to pipes or other household systems

-

The accidental overflow of water or steam

-

Sudden accidental damage from an electrical current

HO-3 (Special Form)

The most popular homeowners insurance option, these policies cover everything HO2 policies do, with the exception of excluded perils like earthquakes and floods.

HO-4 (Tenant's Form)

HO-4 policies are tailored to the needs of renters, offering protection for personal belongings and liability only.

HO-5 (Comprehensive Form)

This policy offers the greatest level of protection available. It's an open perils policy, so the only exclusions are those listed in the policy description. The main difference between an HO-3 policy and an HO-5 policy is that the latter offers more comprehensive coverage.

HO-6 (Condo Form)

These policies are specifically tailored to condo owners and provide protection for personal belongings, liability, and the interior of the home.

HO-7 (Mobile Home Form)

This policy is essentially and HO-3 policy but for manufactured and mobile homes.

HO-8 (Older Home Form)

As the name suggests, this is the policy to buy if you live in or are financing an older home. The age requirements vary between insurance companies.

Pricing & Discounts

A cohesive claims process is among the most important things for policyholders. Studies show that

The timeframe for a claim to be settled will depend on the nature of the claim as well as the documentation that has to be submitted for it to be approved by the insurer, but there are some general guidelines you can follow to determine if the company you're considering offers a hassle-free experience in this area.

According to our research, leading insurers make it easier for their policyholders to file claims by offering convenience in the form of:

-

24/7 claims processing

-

Several ways to file claims: online, over the phone, through a mobile app

-

A general time frame to approve or deny your claim

-

A list of all the information they'll require from you come time to file a claim

-

A streamlined process using the latest technological innovations

One more detail to keep in mind about homeowners insurance claims is that your premiums won't rise as soon as you file a claim for a major loss. This is a common misconception we've heard repeated, but according to insurance expert Gilberto Sánchez, you shouldn't abstain from filing claims out of fear of increasing your premiums.

"What matters most to insurance companies isn't the claim amount, but how frequently you file claims. You can file one large claim per year and see no increase in your premiums, but if you file four claims in a year, your insurer might consider upping your premium or even a non-renewal," said Sánchez.

Customer Service

When consumers are first shopping for insurance of any kind, they might be surprised to see a high number of negative online reviews about insurance carriers on the websites of organizations like the Better Business Bureau and Trustpilot.

These reviews, however, must be taken with a grain of salt. Andrew Thomas writing for Inc.com reveals that, in his experience, customers who have had negative experiences are likely to share said experience by leaving a bad review. On the contrary, customers who have had positive experiences are less likely to leave a good review.

Statistics show that people who feel strongly about a product or service, whether positive or negative, are 33% more likely to write an online review. The problem there is that said reviews are influenced by emotions and personal motivations, a subjective criteria. In short, online reviews appear to be less trustworthy than we would like to imagine.

That being said, reading online consumer reviews could help you detect patterns of behavior that might indicate either high regard or a complete disregard for customer service. In general, it's a good sign when companies answers positive or negative reviews online because it means they value their customers' feedback.

Great customer service is always essential when it comes to home insurance, especially during the claims process.

Someone filing a claim is already going through a highly stressful and frustrating situation, and in that moment what they need most is a fast and seamless claims process, and guidance from a highly trained insurance specialist who can be patient, informative, and empathetic.

According to Bain’s Customer Behavior and Loyalty in Insurance report, when policyholders are filing a claim after an accident, theft or injury, which can be a stressful situation, they expect their insurers to help ease their anxiety as opposed to adding to it.

After speaking to a flood survivor who lived near the coast in San Juan, Puerto Rico, during the aftermath of hurricane María, we were able to corroborate the importance of good customer service during the claims process.

As Nick C. pointed out, his experience would have been very different if his insurance company had taken the time to explain his coverage in detail and show empathy toward him during his time of need.

When comparing carriers, we also noted that insurers with the best customer service ratings tend to offer 24/7 support and several different ways to reach their company representatives. Albeit a small detail, these features can be an indicator of a company's service standards and general appreciation for their customer base.

Financial Strength

Knowing how financially stable your insurance company is can serve a dual purpose, reassuring you that you've made the right call by doing business with that particular carrier and that the company is solvent enough to pay your claim in the event of a total loss due to, for example, a natural disaster.

We know that deciphering financial strength ratings is no easy task, so we've compiled the most important data in an easy-to-understand format to help you navigate the ins and outs of homeowners insurance. Here's a breakdown of what financial strength ratings mean:

As homeowners ourselves, we understand the value of feeling protected against the unknown, especially given the string of natural disasters that have taken place across the nation in recent years: from wildfires in California to Hurricane Harvey, Maria, and Katrina in Florida, Louisiana, and Texas, just to name a few states.

Certainly, your geographical location will dictate your insurance needs as well as the rates available to you. In short, when it comes to homeowners insurance, the most important thing you'll have to determine is your risk.

According to the Insurance Information Institute (I.I.I.), there are two ways of looking at loses for homeowners insurance, by severity and by frequency. The most frequently filed claims between 2012 and 2016 were for wind and hail damage, while the most severe losses were caused by fire and lightning.

But these aren’t the only perils threatening your property and belongings; depending on where you live, you might be at greater risk of earthquakes, fires, floods, and other natural phenomena that aren't covered under a standard homeowners insurance policy.

Add-On Coverages

Add-on coverages, riders, floaters or endorsements all refer to supplemental coverages you can add to an insurance policy for enhanced protection. Although these products cost extra, they can help you customize your plan according to the risks in your area.

Flood Insurance

Do you live in an area prone to flooding? Are you wondering if your homeowners insurance covers water damage? Then know that your homeowners insurance policy might not cover you in the event of a flood or even water damage to your home. To protect your home against this peril, consider purchasing an add-on flood coverage or rider for your homeowners insurance policy.

According to the National Flood Insurance Program (NFIP), about 90% of natural disasters in the U.S. involve flooding. The I.I.I. also informs that flooding is among the costlier natural disasters, causing billions in damages every year.

The NFIP is a government-sponsored program that aims to reduce the impact of flooding on both public and private structures by offering affordable insurance to homeowners, renters, and businesses. It also encourages communities to adopt floodplain management regulations.

The program offers coverage for up to $250,000 for the main structure of the home and up to $100,000 for personal belongings. Consumers looking for more than the maximum coverage will have to purchase private insurance.

Given these flood statistics and the fact that insurance companies in states like Florida are dropping coverage for policyholders in higher risk areas, consumers cover direct physical damage from floods and losses resulting from flood-related erosion due to storms, flash floods, tidal surges, etc.

Consumers should be aware of the fact that flood insurance doesn't typically cover personal belongings, systems or appliances

It should be noted that these policies require a 30-day waiting period before they kick in.

Earthquake Insurance

Despite the fact that earthquakes can occur in every US state and territory, the percentage of people insured against them is drastically low.

According to the NAIC, about 90% of us live in areas prone to earthquakes, with higher risk the further West you go. However, a 2016 poll by the Insurance Information Institute (I.I.I). found that only 8% of homeowners had bought earthquake insurance.

There are a couple of factors that contribute to this low percentage. First off, a lot of homeowners don’t know that standard home insurance policies don’t cover earthquake damage. Secondly, earthquake insurance policies usually feature a high deductible. These two factors, combined with the fact that most people tend to think that the chances of a catastrophic earthquake occurring in their area are slim, result in fewer homes being insured against earthquakes.

Earthquake insurance protects you against all of these problems and more, including repairs needed for your dwelling (house, apartment, place of residence) and can also cover structures not attached to your house, like a garage or a shed.

Dog Bite Liability

If you own a dog, it’s important that you know certain breeds pose a greater risk to insurance companies. Because of this, they'll try to shift some of the financial responsibility to you by charging higher premiums or denying you coverage altogether.

Common dog breeds deemed as "dangerous" include Pitbulls, Rottweilers, Dobbermans, Dalmatians, Dobermans, Great Danes, Terriers, Chow Chows, German Shepherds, and Siberian Huskies, just to name a few.

According to the I.I.I. and State Farm, in 2012, dog bites accounted for more than a third of homeowners insurance liability claims, causing expenses of up to $489 million.

Dog owners should be aware that standard homeowners insurance policies typically cover dog bite liability expenses ranging from $100,000 to $300,000. If the claim exceeds that limit, the owners will be responsible for the damages caused by the dog.

Some insurers, however, don't ask about your dog's breed when issuing you a policy. Whether or not your carrier requires this information will depend on your state of residence.

For example, Pennsylvania and Michigan have passed laws that prohibit insurance companies from cancelling or denying coverage to owners of dogs considered "dangerous" or "vicious."

Those who are seeking coverage from a company that does look into dog breeds before issuing their policies can take some steps to minimize the potentially high costs of homeowners insurance.

According to the American Kennel Club, enrolling your pet in an obedience training course and getting them certified as a good citizen can prove that your dog can be well-behaved around other dogs and people.

The I.I.I. also states that many insurers will accept certificates from the AKC's Canine Good Citizen Program and others.

FAQs about Homeowners Insurance

What does homeowners insurance cover?

Homeowners insurance covers damage to your home and property caused by certain perilous events such as fires, storms, theft, and other disasters. Many policies also offer personal liability coverage, which will help pay for legal fees and medical payments if someone is injured while on your property.

What does homeowners insurance not cover?

Homeowners insurance does not typically cover damage caused by floods, earthquakes, or routine wear and tear. You will need to purchase additional coverage for these types of events. In addition, most standard homeowners insurance policies do not include coverage for high-value items such as jewelry, electronics, and other rare collectibles. You may be able to get an add-on to your policy to cover these more valuable possessions.

How is homeowners insurance calculated?

Homeowners insurance is usually calculated based on the value of your home and its contents, along with any other structures on the property. It may also take into account the age and location of your home, as well as any additional safety features that are installed. As can be imagined, there are a huge number of variables within each of these categories that affect the overall cost of your premium. Thus, every insurance company has its own method for calculating and setting the cost of a specific policy.

Do I need tiny house homeowners insurance?

If you have a tiny home, we highly encourage you to get it insured. Most tiny homes cost anywhere between $10,000 and $100,000 to build—add the value of all of your belongings inside, and theft or a fire could end up costing you over $150,000 and your peace of mind.

When choosing insurance for your tiny home, the first thing to know is that—just as it is with regular home insurance—there’s no one perfect insurance plan that applies to every tiny home. Tiny homes range widely in size, structure, mobility, foundation, main use, etc. If your tiny home is on wheels, for example, you might be better served by opting for RV insurance, but it’s important to know that if your tiny home is a DIY (Do it yourself) project, you probably won’t be able to get RV insurance coverage because of certain qualification requirements. Whether you use your tiny home as your primary residence or as a vacation home matters as well, since some RV Insurers will not insure primary residencies. Tiny homes that have wheels are also especially vulnerable because they can be stolen and are also exposed more often to danger if they’re being driven from one place to another.

For those who did go the DIY-route or have a stationary tiny home and could not get their tiny home RV insurance coverage, there’s the option of going for a specialized “tiny home insurance” product from any insurance agency that offers it—just make sure that the company is financially stable and highly reputable. A good way to check for this is looking up prospective companies on AM Best.

The most important part is to make sure you have liability coverage (in case someone gets hurt inside your tiny home), coverage for the structure, and coverage for everything inside (your personal belongings).

Is homeowners insurance required by law?

No, homeowners insurance is not a legal requirement in any state. However, mortgage lenders require borrowers to purchase homeowners insurance to safeguard their investment, meaning the funds they are lending for the purchase of a property.

Why should I buy homeowners insurance if I don’t have to?

In essence, insurance is a financial tool that protects an investment against certain risks. Insurance companies assume part of that risk by offering to cover a percentage of potential damages that are assessed according to each insurer’s particular actuarial formulas. By risk pooling or distributing the financial responsibility of predetermined risks among a large group of people (policyholders), insurance companies are able to make a profit while helping their customers protect their assets, meaning their homes and belongings. Although not a legal requirement, homeowners insurance is a financial safety net that can help you bounce back quicker after a major loss. Those who live in high-risk areas where their homes can be damaged by severe weather, theft or vandalism should consider purchasing this type of product. If you’re a homeowner or renter who keeps personal belongings in their car, owns a breed of dog that is considered “aggressive,” or lives in an area where crime rates are higher than the nationwide average, we also urge you to look into the potential benefits of homeowners or renters insurance. Higher risks will translate into higher homeowners insurance premiums, but the alternative may not be an option for you. Many homeowners, especially those who reside in areas prone to storms and wildfires are particularly susceptible to greater losses.

What is covered in a standard homeowners insurance policy?

Standard homeowners insurance policies offer protection for the homeowner in the form of liability coverage as well as for the main structure of the home, the personal items stored within, and some detached structures on the property like tool sheds and garages. In short, most policies typically offer: Dwelling Coverage Coverage for "Additional Structures" Personal Property Coverage Additional Living Expenses Coverage Personal Liability Coverage All homeowners insurance policies cover specific perils listed in the coverage description, which typically include fire, strong winds, hail, and lightning, among others. Covered perils will vary depending on the company and the type of homeowners insurance policy you select: Typically covered perils include: Smoke or fire Lightning Wind or hail Explosions Riots, malicious mischief, and vandalism Damage by aircrafts Damage by vehicles Theft Volcanic eruptions Falling objects The weight of ice, snow or sleet The most commonly excluded perils are floods, earthquakes, hurricanes, mold, infestations, and neglect.

How much homeowners insurance do I need?

In order to determine how much homeowners insurance you need, first consider the full replacement cost–not the market value–of the house. In other words, the total cost to completely rebuild the house using similar materials, to which should be added the value of your personal property. Most authorities recommend estimating replacement cost of personal property at between 50% and 75% of the coverage for the dwelling itself. For example, if it would cost $150,000 to completely rebuild the house, a homeowner might want to add in at least $75,000 in coverage for personal possessions, for a total coverage of $225,000. Homeowners with more expensive and valuable possessions should consider purchasing additional "floaters."

How much is homeowners insurance on average?

According to the Insurance Information Institute, the nationwide average cost of homeowners insurance was $1,192 in 2016, an increase of $54 from the previous year and $41 from the year before that (2014). Homeowners insurance rates vary considerably by state, with Florida and Louisiana having some of the most expensive rates. With this in mind, prospective homeowners will need to assess their risks and take into account other factors that could potentially increase the cost of their policies, such as owning an "aggressive" dog breed, a pool, or a trampoline. There are many other factors on which rates are based, however, including your home’s value, age, quality of construction and materials used, location, your credit score, preventative measures taken (such as smoke detectors or home security systems), and your desired coverage limits and deductible.

Our Homeowners Insurance Review Summed Up

| Company Name | The Best for |

|---|---|

| Liberty Mutual Home Insurance | Older Homes |

| Lemonade Home Insurance | Condos |

| USAA Home Insurance | Veterans |

| Allstate Home Insurance | First-time Buyers |

| Progressive Home Insurance | Manufactured Homes |