Best High Yield Investing Opportunities for 2023

- 200+Hours of research

- 20+Sources used

- 20Companies vetted

- 0Features reviewed

- 10Top

Picks

- Investors have quite a few choices when seeking out low-risk, high-yield financial opportunities.

- Low-risk opportunities vary in terms of return on investment and liquidity.

- Low-risk investments are categorized as such because they are either government-guaranteed or protected by FDIC or SIPC insurance.

- Some low-risk investment vehicles are available through a wide range of financial institutions, while you can only access others through the US Treasury Department.

- A balanced portfolio consists of low-, moderate- and high-risk investments.

- When your investment goals change, so should your strategy.

Best High Yield Opportunities

We live in turbulent financial times. In the latter part of 2022, inflation rates reached 8.5% — the highest we’ve seen since 1982. The stock market, which, after a brief crash, was going gangbusters for the better part of the pandemic, went bearish again in 2022. The collapse of Silicon Valley Bank precipitated global concern about the banking industry as a whole and, fearing more volatility in the banking industry, investors and non-investors alike are feeling leery and unsettled. It’s no wonder some consumers are questioning the wisdom of high-risk investing and seeking some safer haven.

Whatever your reasons for trying to limit your investment risk — and there are potentially many — the good news is that you have a number of relatively safe investment options. Some are virtually risk-free. Let’s take a look at the best yield investment choices you can make in 2023 to limit your financial exposure and weigh their advantages and disadvantages against one another.

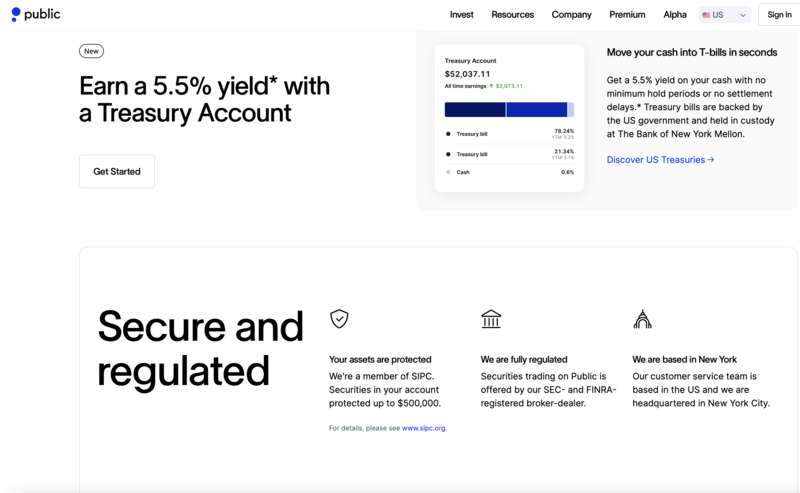

Public.com offers investors a wide range of investment opportunities, including T-bills, ETFs, crypto, stocks, and alternative assets. Investors can choose the level of risk they want to take and diversify their portfolios by selecting one or more of these options:

Invest in Treasury Bills

Currently, treasury bills offer a 5.5% yield when you purchase and hold them for a 6-month period. That's considerably higher than a year ago, when they offered 3.98%. Financial advisors generally consider treasury bills a relatively safe investment because they are backed by the US government. Rates are subject to change, however, and assets are not FDIC-insured.

Screen shot from Public.com 10/06/2023

Disclosures:

All U.S. treasury investments and investment advisory services provided by Jiko Securities, Inc., a registered broker-dealer, member FINRA and SIPC. Securities in your account are protected up to $500,000. For details, please see www.sipc.org.

Investments in T-bills: Not FDIC Insured - No Bank Guarantee - May Lose Value Banking services provided by Jiko Bank, a division of Mid-Central National Bank.

Jiko Group, Inc. and its affiliates do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. See FINRA BrokerCheck, Jiko U.S. Treasuries Risk Disclosures and Jiko Securities Inc. Form CRS.

Invest in ETFs

Exchange-traded funds are similar to mutual funds. They represent an opportunity to invest in multiple stocks at one time, thereby spreading the risk of investing. ETFs differ from mutual funds because investors trade them on stock exchanges. They are not guaranteed investments—the price per each stock's share and even the contents of the fund will vary according to market conditions and the investment strategy followed by the fund manager. Typically, ETFs track to an index, such as the Dow Jones Industrial Average, Nasdaq 100, or S&P 500. One advantage of investing in ETFs is that they offer low expense ratios. Investors pay less in commissions than they'd pay if they purchased stocks individually.

Invest in Cryptocurrencies

You can trade seven different cryptocurrencies through Public.com. Currently, they include Bitcoin, Ethereum, Dogecoin, and Litecoin. The minimum investment you can make in crypto through Public.com is one dollar and the maximum is $100,000.

Screenshot from Public.com 10/06/2023

New for 2023: Invest in Music Franchises

Recently, Public.com announced that Shrek Royalties LLC will purchase 25% of the interest of composer Harry Gregson-Williams to 768 tracks of score music written for the Shrek film franchise. The portfolio generates royalties each time the films Shrek, Shrek 2, Shrek the Third, and Shrek Forever After and the TV special Shrek The Hallsare aired or music from the properties are streamed. The company will offer 88,970 shares of the stock at $10 per share, for a total of $889,700. Last year, the property generated $83,059 in royalties.

Screenshot from Public.com 10/06/2023

Public.com Summed Up

Public.com offers multiple investment options so investors can tailor their portfolios to their interests, risk tolerance levels, and investment strategies. New for 2023, the company offers investors the chance to buy into the Shrek music franchise—one more way to diversify their assets. Public.com is suitable for both new and experienced investors. The compay makes investing convenient by offering one place to manage all assets they invest in through the company. In addition, it allows users to automate their investments and overall investment strategy. Public.com is A+ rated by the Better Business Bureau.

- Earn over five times the national average with a high-yield savings account

- Earn 4.20% APY on your deposits*

- No minimum opening deposit

- No monthly maintenance fees

- No overdraft fees

- FDIC-insured

*Rates current as of 10/27/2023

- Open an account online in five minutes

- Earn 4.15% APY on your deposits

- No minimum opening deposit, minimum monthly balance, or maintenance fees

- Set up automatic savings through the top-rated Capital One mobile app

- Easy internal and external transfers

- FDIC-insured up to $250,000

*Rates current as of 6/23/2023

- Earn 3.75% APY on your deposits

- No minimum opening deposit

- Earn highest APY with no minimum balance

- Multiple insight tools and trackers help you see your savings clearly

- FDIC-insured up to $250,000

*Rates current as of 3/26/2023

- Earn 13 times the national savings account average

- Pays 5.00-5.90% APY interest

- Your funds invested in real estate lending

- Interest paid daily

- 100% liquid: withdraw funds at any time

- Deposits not FDIC-insured

*Rates current as of 3/26/2023

*Rates current as of 3/26/2023

- No minimum opening deposit

- No monthly service fees

- No minimum balance required

- No-fee overdraft protection up to $200

- Get cash at more than 50,000+ fee-free ATMs

- No foreign transaction fees

- Earn 5.15% APY on a 27-month CD

- Earn 5.00% APY on a 23-month CD

- No-penalty CDs available for 10 or 14 months

- No minimum deposit or maintenance fees

- Deposits are FDIC-insured up to $250,000

*Rates current as of 3/26/2023

*Rates current as of 3/26/2023

- Earn 4.00% APY with qualifying direct deposit of $200

- Create up to three separate savings pods to save for individual goals

- Make saving painless and automatic with purchase round-ups

- 40,000 fee-free ATMs in the US

- Deposits are FDIC-insured up to $250,000

*Rates current as of 3/26/2023

*Rates current as of 3/26/2023

Guide to High Yield Investing

In practical terms, certain investments — like putting your money in a savings account, domestic certificate of deposit (CD), or a money market account — are risk-free or near-risk-free. So long as you don’t keep more than $250,000 in the same type of account with the same FDIC-insured financial institution, you won’t lose your money. So keep an eye on those limits. You may have to bank with more than one institution to enjoy the protection of FDIC insurance.

Once again, you have quite a few choices when trying to temper your financial risk. We’ve selected five investment options that qualify as low-risk / high-yield. Arguably, there are other low-risk opportunities out there. But we’ve selected what we consider the safest among the safest for those who are serious about protecting their wealth.

High-Yield Savings Accounts

Pros:

- Deposits are FDIC-insured

- High liquidity: you can access your funds whenever you need them

Cons:

- Comparatively low rate of return on your investment

- Interest rates are subject to change

If you have a traditional savings account, you’re probably aware that you’re not earning oodles of money on your deposits.

Interest rates fluctuate according to various factors, including the Federal Reserve rate, the demand for credit and inflation. Right now, traditional savings account interest rates are on the upswing. That’s because the Federal Reserve has hiked (and continues to hike) its interest rates and inflation has risen to a level where everyone is feeling the pinch. But the return on a savings account balance is still hovering at a paltry 0.23%.

But you may be able to get a much better deal if you open what's known as a high-yield savings account. Interest rates on high-yield savings accounts are currently over 3% and may even earn more than 4%, depending on where you bank.

So what’s the catch? Unlike traditional savings accounts, high-yield accounts may require an initial minimum deposit. The minimum deposit threshold can be quite high: some banks set it at $1,000 or more. In addition, you may be required to maintain a minimum balance or otherwise encounter certain fees. Little dings, such as overdraft fees, are typical with high-yield savings accounts. So if you’re shopping around for a high-yield savings account, be sure to compare requirements and fees, including monthly maintenance fees, to make sure you’re getting the best deal for your personal financial position.

All that being said, high-yield savings accounts offer the same low level of risk as traditional savings accounts. They’re FDIC-insured, so as long as you only keep one savings account per bank with a balance below $250,000, your funds are protected.

CDs

Pros:

- Guaranteed fixed return

- Wide selection of terms and rates

- FDIC-insured

Cons:

- Less liquid than savings or money market accounts

- Early withdrawal penalties may apply

CDs, or certificates of deposit, are another safe, FDIC-insured investment. Currently, CD rates are competitive with high-yield savings account rates. But when you purchase a CD, you must commit to staying invested for a period of time ranging from just a few months to ten years. The longer you commit to keeping your funds in a CD, the higher the interest rate you’ll earn. However, if you withdraw your money from a CD before its maturity date, you will be subject to penalties.

Penalties for early withdrawal can be steep. If you purchase a short-term CD — say with a three-month maturity date — and withdraw your funds early, you’ll basically sacrifice all of the interest you’ve earned while you held the instrument. With a one- to seven-year CD, if you withdraw your funds within the first year, you’ll lose 12 months of your expected earnings. If withdrawn after one year, you can lose as much as 30% of your expected earnings for the full term of the CD. So it’s best to purchase a CD for a period when you can be sure you won’t need access to your funds.

So why would someone choose to buy a CD rather than stash their cash in a high-yield savings account? The primary reason is that if you hold your CD for its entire term, you’re guaranteed to earn the rate you bargained for at the time of purchase. High-yield savings account interest rates, by contrast, can fluctuate considerably over the same period of time.

Money Market Accounts

Pros:

- Higher interest rates than checking accounts

- Full liquidity

- May come with a debit card and/or paper checks

- No penalties for early withdrawal

Cons:

- High minimum deposits may be required

- Limited number of free transactions per billing cycle

- You may be charged maintenance fees if you don’t maintain a minimum balance

Money market accounts offer a combination of security and liquidity. The funds held in a money market account are protected by FDIC insurance. Plus, you have 24/7 access to your funds. In fact, some money market accounts come with debit cards and paper checks.

But it’s best not to use your money market account the way you would a checking account and here’s why. With a money market account, you’ll typically be limited to a certain number of free withdrawals or transfers per statement cycle — usually six. Make more than six and you’ll pay additional per-transaction fees.

In addition, money market accounts may come with minimum balance requirements. Fall below your minimum balance and monthly maintenance fees may be deducted from your account.

Money market interest rates may be slightly higher than high-yield savings account rates. But the two investment vehicles share one similarity: interest rates for both fluctuate and you are not guaranteed steady earnings.

Treasury Bills

Pros:

- Guaranteed by the US government

- Short-term investment (up to one year)

- Fixed interest rate

- Low price of entry: minimum commitment of $100

- Typically offer higher interest rates than savings accounts and money market accounts

Cons:

- Funds are not liquid

- May yield lower returns than long-term CDs

- T-bill interest rates fluctuate, subjecting you to opportunity risks

Treasury bills, commonly known as T-bills, are securities issued by the Treasury Department and are backed by the full faith and credit of the US government. T-bills are regulated by the Securities and Exchange Commission, as well as the Financial Industry Regulatory Authority (FINRA), which designates and enforces rules for registered brokers and brokerage firms.

T-bills are short-term investment vehicles. You can buy a T-bill that matures in just a few days. And the maximum term of a T-bill is 52 weeks. Unlike the funds you put in a savings account, your T-bill investment offers a fixed interest rate for its term and cannot be withdrawn before maturity. But you’ll earn more with a T-bill investment than you would with a high-yield savings account or checking account. In March 2023, the interest rate for a three-month T-bill was 4.63%.

T-bills may be purchased directly from the government or on the secondary market. If you purchase your T-bills from a brokerage firm, your investment is protected by SIPC insurance up to $500,000. So if your brokerage firm fails, you won’t be hung out to dry.

Other advantages of T-bills include a low cost of entry. Just $100 can put you in the T-bill game. And there’s no limit on how much you can invest in T-bills. But if you buy T-bills through a brokerage, just be careful not to exceed a $500,000 investment with one firm, or you’ll lose your SIPC protection.

In addition, your T-bill earnings are exempt from state and local income taxes. Depending on how much you earn and where you live, your tax savings could be substantial.

Series I Savings Bonds

Pros:

- Guaranteed by the US government

- Designed to protect your investment from inflation

- Pays two kinds of interest: a fixed rate and an inflation-adjusted rate

Cons:

- Annual limit on how much you can invest

- Interest rate can change every 6 months

- Long maturity dates

- Limited liquidity: no withdrawals for the first year

Series I Bonds aren’t as widely known as T-bills. The financial press doesn’t report on them as regularly, but they’re another form of government-backed security that carries low-risk compared to many other investments you can choose.

Unlike T-bills, Series I bonds are relatively long-term investments. The shortest term for an I bond is 5 years. But I bonds can continue to earn interest for much longer if you don’t cash them in up to 30 years.

You must hold on to your Series I bond for at least one year. So right off the bat, an I bond is less liquid than many other low-risk investments. After one year, you can cash in your bond prior to its maturity date, but penalties will apply. Early withdrawal penalties are lower, however, than they are with CDs, for example. After a year, you will only lose three months of interest no matter how far in advance of your bond’s maturity date you decide to cash out.

I savings bonds earn interest monthly and interest is compounded semiannually. Interest is rolled into the bond’s principal, so you earn more interest the longer you hold on to them.

The interesting thing about I bonds, if you’ll pardon the pun, is that they pay two kinds of interest. You earn a guaranteed interest rate for the first six months that you hold the bond. But every six months, the rate is adjusted according to the current rate of inflation. That new rate is called the composite rate. When the inflation rate goes up, so does the amount of interest you earn on each dollar you’ve invested. That’s why I bonds are considered a great hedge against inflation — something everybody could use right about now, right? But the reverse is also true. You may earn less interest when inflation subsides.

Series I bonds return at a higher rate than T-bills. In March 2023, I bonds were delivering 6.9% at inception. That rate will be adjusted, but the composite rate on Series I bonds is predicted to rise.

All that sounds like a pretty great deal for a security that’s federally guaranteed. But there is one drawback to investing in Series I bonds. Unlike T-bills, I bonds are not an all-you-can-eat buffet. You can’t go back for seconds right away. The Feds limit the amount you can invest in I bonds to $10,000 per calendar year.

You can buy Series I bonds directly from the government when you open a TreasuryDirect account. The minimum purchase is $25. That makes the investment vehicle a great choice if you’re new to investing or simply don’t have a lot to invest. Unlike T-bills, you can’t buy Series I bonds on the secondary market.

FAQs about High Yield Opportunities

Is Low-Risk Investing Right for You?

Not to be glib about it, but low-risk investing is good for everyone. In fact, all but the unbanked among us are already invested in low-risk positions. Your savings and checking accounts count as such.

Most financial advisors recommend that you maintain a balance of investments, spreading your cash among low-risk, moderate-risk and high-risk investments. But the precise balance they advise can change over time, based on various factors.

When Should I Consider Going Low-Risk with My Investments?

When you’re just starting out as an investor, choosing low-risk investments is probably the way to go. Take some time to educate yourself on your various investment opportunities before jumping head-first into riskier propositions.

Low-risk investing is also a good path for people who don’t have a large amount of money to invest. The most conservative advisors will tell you never to invest more than you can afford to lose. And you’ve probably heard this disclaimer countless times: all investments come with risk.

There are certain times in your life when low-risk investing makes the best sense. If you anticipate having to pay for large expenses, like your kids’ college education, it’s better not to put your cash at risk. Financial advisors also recommend you shift your investment strategy the closer you come to retirement. They’ll typically advise you to get out of high-risk and speculative investments, including stocks and cryptocurrency.

But sometimes it comes down to personality. Some of us are just temperamentally risk-averse at any age or no matter how much cash we’re sitting on. It’s perfectly acceptable to stick to low-risk investments just for your peace of mind. Don’t let anyone bully you into taking more risk than you’re comfortable with. It’s kind of like skydiving. It’s no fun at all if you’re terrified the whole time you’re in the air.

Which investment option is the safest?

So long as you invest with a bank that is FDIC-insured, savings accounts, CDs and money market accounts are protected up to a value of $250,000. The only caveat is that you should not invest more than that amount in a single investment category with the same bank. High-yield savings, CDs and money market accounts offer the same level of security. But each offers advantages and disadvantages that may make them more or less attractive to an individual investor.

Which low-risk investment option has the potential to earn me the most money?

That’s difficult to say. Interest rates on each of the low-risk investment categories we’ve discussed are subject to many economic forces — and not always in the same way. For example, when loan interest rates are low, the yield on T-bills tends to drop. This dynamic works in reverse, too. CD interest rates rise when the Federal Reserve Bank raises its rates. We have a recent example of this: CD rates have climbed as the Fed responded to our current high rate of inflation by raising its rate. So in terms of ROI, low-risk investments fluctuate with the times.

What are the negative implications of investing only in low-risk positions?

The chances of getting rich when you choose only low-risk investments are low. But so are the chances of losing your shirt. It’s a bedrock principle of investing: with greater risk comes the potential for greater rewards. For many people, the benefit of low risk outweighs the benefit or high reward. But your mileage may vary.

What is a balanced portfolio?

A balanced portfolio typically combines investments in cash, stocks and bonds. Real estate holdings may also be part of a balanced portfolio. The idea of balancing your portfolio is to manage your risk while also maximizing your potential for higher returns.

How often should I reassess my investment strategy?

The goal of rebalancing your portfolio is to keep your investments in line with your level of risk tolerance. Reallocating assets may be based on the volatility of any particular one. Most financial advisors suggest that balancing your portfolio every six months is a sound plan. At a minimum, it’s a good idea to review your portfolio once a year. But if your investment goals change — for example, when preserving your wealth for retirement becomes a priority — it might be time for a strategic tune-up.