Best Credit Monitoring Services Based on In-Depth Reviews

- 200+Hours of research

- 20+Sources used

- 20Companies vetted

- 4Research Criteria

- 8Top

Picks

- Credit monitoring protects you from fraud and theft

- Some companies will inform you of irregularities almost immediately

- You might already have theft protection and not be aware of it

- Free and paid premium services are available

HOW WE FOUND THE BEST CREDIT MONITORING SERVICES

Our Top Picks: Credit Monitoring Reviews

This site does not include all companies or all available offers. Companies listed below are listed in alphabetical order.

Best Free Service

Credit Karma is a personal finance company founded in 2007. They offer a variety of services, including free tax preparation, report error identification, and credit monitoring. All sensitive information is encrypted, which may provide customers some assurance that it will be kept safe from hackers.

Besides providing credit monitoring service at zero cost, their website is filled with credit-related information. This may be helpful for someone looking to better understand their credit situation and devise the next steps to achieve their goals, whether that’s keeping your credit safe from bad actors or monitoring your credit score while you try to raise it.

Screen shot of creditkarma.com, July 24, 2019.

No Credit Card Required

Credit Karma’s monitoring service does not require you to enter your credit card information. Signing up is as simple as filling out some basic data, entering the last four digits of your Social Security number and confirming your identity.

Almost immediately, you will see your credit score from TransUnion and Equifax. You might also get invited to apply for a new credit card. At this point, your credit is already being monitored and you’ll be alerted via email or app notification if there are any changes.

Credit Karma looks into two bureaus, TransUnion and Equifax. They give you an idea of your credit scores, but they use a credit-scoring model called VantageScore. While this method of calculating creditworthiness may tell consumers whether their credit score is improving, staying the same, or declining, it is not the FICO score generally used by banks, mortgage companies, and other financial institutions.

Numbers and Bottom Line

To reiterate, Credit Karma is a zero-cost service offering. Their credit monitoring service will allow you to keep an eye on the progress of your credit score. The service also looks for errors in your report, signs of identity theft and anything that may be considered suspicious. In the event that Credit Karma picks up on any of these, you will be alerted. You can even check what data breaches exposed your information and which one of your passwords was possibly compromised.

We’ve come across some customers reporting difficulty in reaching Credit Karma’s customer service. That said, considering this is a free and largely automated service, we would urge you to manage your expectations.

While Credit Karma stands above other free services, it still provides monitoring that some users may consider limited. Hence, we encourage you to try a free service because there is little to no risk involved. If you find your needs require premium monitoring, read on and learn about the other services highlighted below.

Best Value

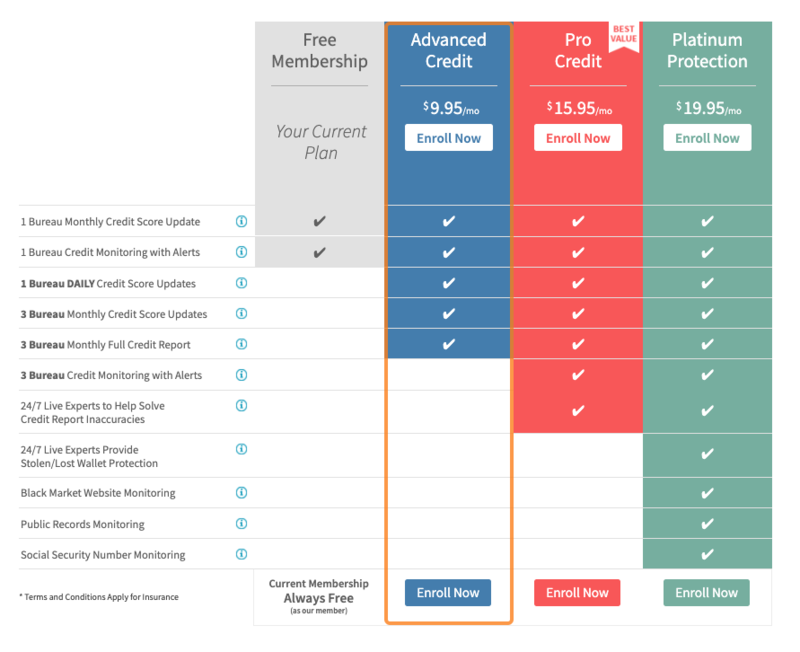

Credit Sesame is a financial wellness company launched in 2010. While Credit Sesame does offer a free service, we focused on its three paid plans and the value they can offer you. Out of these plans, the basic one isn’t necessarily the most comprehensive, but you can’t beat its monthly price at just $9.95. Yes, you could find basic monitoring for about a dollar less, but no other service at this price offers access to all three bureaus, and certainly not with the same amount of positive reviews as Credit Sesame.

Once you’re logged in, Credit Sesame will tell you the total amount of the money you owe, while offering you advice on how to improve your credit standing. If you’re looking to raise your score and want to monitor your progress, Credit Sesame allows you daily access to one bureau and monthly access to all three. This way you can constantly check your score, stay on track, and receive notifications regarding any changes. Unlike other services, Credit Sesame does not offer a family plan. But for such a low monthly cost, it’s hard to argue with the value they provide.

What Sets Them Apart

With Credit Sesame, you get monthly updates from all three credit bureaus for just under $10. If you want to reach and maintain a healthy credit score, these monitoring tools are essential. We can’t stress enough the importance of good credit and the money you will save over your lifetime. Credit Sesame provides you with all the tools and resources you’ll need to achieve this without breaking the bank.

Plans include $50,000 in identity theft insurance, $1 million with its top-tier plan, but no reimbursements for incurred costs. If you’ve been a victim of identity theft, this insurance can set your mind at ease.

Low Pricing

Credit Sesame offers one of the lowest monthly fees we’ve encountered. Their basic plan, Advanced Credit, includes daily access and monitoring for one bureau, as well as a monthly report with updates from all three bureaus, for $9.95 a month. Pro Credit, their second plan labeled as ‘Best Value’ on their website, includes access to live experts and daily monitoring of all three bureaus, for $15.95 a month. Dark web and Social Security number monitoring are only included with the Platinum Protection plan at a cost of $19.95 a month.

Screen shot of creditsesame.com, July 24, 2019.

Even the most expensive of Credit Sesame’s plans does not exceed $20, making it affordable for consumers on a budget. Despite their low prices, all three plans provide well-rounded services. If you’re looking for value, Credit Sesame has three practical plans for you to choose from.

Best for Identity Restoration

IdentityForce was established in 2006. Besides credit monitoring, they specialize in ID restoration, providing you with an abundance of information to help you handle the potential consequences of identity theft. Picking up the pieces after having your personal identifying information stolen can be a daunting task, but IdentityForce provides you with a long list of resources to make it happen.

In the case of theft, IdentityForce will assume a limited power of attorney to handle your identity restoration with a hands-on approach. They promise to take care of all the paperwork and most of the phone calls to ensure the process is done correctly. This all adds up to a proper identity restoration process, keeping your personal and financial needs as the primary focus.

Beyond Financial Relief

Identity theft can have consequences that go beyond the financial, causing the victim unwanted stress. IdentityForce’s system of identity restoration is designed not only to save you time but more importantly to save you some of the inevitable hassles. The specialists who handle this task are available to you 24/7. Furthermore, IdentityForce offers a $1 million insurance policy with the purpose of reimbursing expenses you might incur as well as relieving the loss of wages that can come about after having your identity stolen. This type of policy may put you at ease knowing that you’d be covered should you become a victim.

Screen shot of identityforce.com, July 24, 2019.

Pricing and Details

IdentityForce offers two plans: UltraSecure for $17.95 a month, and UltraSecure+Credit for $23.95 a month. Family plans are available but the details are not specified on the website. Both plans offer a long list of monitoring services including dark web monitoring, along with bank and credit card activity alerts which will notify you when any withdrawal or transfer exceeds an amount set by you. Other features include Smart Social Security Number Tracker, to alert you if any unknown data is linked to your number in attempted fraud. And should any future data breaches put your information at risk, IdentityForce promises to alert you.

The UltraSecure+Credit plan has additional features related to credit. These include monitoring, reports, and scores from all three bureaus: Equifax, Experian, and TransUnion. Also, this plan includes a Credit Score Simulator, something offered by few plans. This simulator gives you an estimate of how your credit might change should you proceed with a particular financial decision. Need to transfer balances onto a new credit card? The simulator will detail the impact it could have on your credit.

At a Glance

IDShield is more of an identity protection service that offers credit monitoring as a perk. They have two plans for individuals and two plans for families. In the event of ID theft, a team of private investigators will work with you to restore your identity and get you back on track.

To the Point

LifeLock performs thorough credit and identity monitoring to alert you of any suspicious activity concerning your personal identifying information. They aim to help you recover, should you become a victim of identity theft. Only one out of three plans monitors all credit reporting agencies. Additionally, LifeLock allows you to add family members to your plan at a cost.

EDITOR’S NOTE:

In 2015, LifeLock paid a $100 million fee to the Federal Trade Commission. The FTC claimed LifeLock had failed to comply with a 2010 court order concerning deceptive advertising. Furthermore, in 2018 LifeLock was involved in a class-action lawsuit concerning unfulfilled promises that stemmed from misleading advertisements. The company claims no wrongdoing and has stated that 90% of those involved in the lawsuit have stayed on as clients.

The Basics

myFICO’s top-tier plan, FICO Premier, offers considerable credit and identity theft monitoring. That said, this plan is one of the most expensive we’ve encountered at $39.95 a month. Still, FICO provides the most widely used scores by potential lenders and creditors.

Best for Extra Services

PrivacyGuard is a credit reporting, credit monitoring, and identity theft protection service founded in 1991. They offer three plans with a variety of features, some you might find immediately useful and others might serve you well in an unexpected situation. Out of the three plans they offer, one of them hits all the marks concerning perks and benefits. The other two have good but limited features. Another downside is that PrivacyGuard is not available to residents of Iowa, Rhode Island, and Vermont.

What’s Offered

PrivacyGuard offers three plans: ID Protection, Credit Protection, and Total Protection. The ID Protection plan monitors the dark web in case it detects your personal information, alerts you if your ID is used for fraudulent activity, assists in case of lost or stolen credit cards, among others. The Credit Protection plan offers daily monitoring and monthly reporting from all three credit reporting agencies. This plan will provide you with monthly tracking so you can see how your score has changed. Access to personnel via phone will allow you to answer any credit-related questions or assist you in disputing negative items on your report. While the Credit Protection plan also offers Social Security number monitoring, PrivacyGuard specifically warns that it’s impossible to scan all public data sources.

Screen shot of privacyguard.com, July 24, 2019.

One feature that stands out is the Digital Protection app, equipped with a safe browser and a secure keyboard. This app may provide you with an extra layer of privacy when carrying out purchases or sharing sensitive information online. The data theft prevention software is meant to give you a safe browsing experience from your mobile device or desktop computer.

The Total Protection plan consolidates all the features mentioned above under one plan. We must mention that all these services are plans for individuals and a family-type plan is not offered by PrivacyGuard.

Dollars and Fine Print

Plans are priced as follows: ID Protection at $9.95 a month, Credit Protection at $19.99 a month, and Total Protection at $24.99 a month. PrivacyGuard’s website offers detailed information on every benefit in layman’s terms, so you can have an informed idea of what you’ll get. Moreover, PrivacyGuard offers a 14-day trial at a cost of just $1, so there’s not much to lose if you decide it’s not for you.

To receive the most benefits with thorough protection, we recommend PrivacyGuard’s Total Protection plan. If you find you require less to fulfill your needs, ID Protection and Credit Protection are worth considering.

Brief Details

WalletHub offers free credit monitoring. However, the value they offer goes beyond a no-cost service. Their website is a hub of free educational articles, as well as calculators that help you weigh in on possible adjustments to your mortgage, car payments, student loans, among others. All in all, they are a good resource of information for those who want to know how to achieve better finances.

More insight into our methodology

As our team began to research credit monitoring services, we quickly realized there was something unique about this industry. And that is the fact that consumers can get it for free. That’s right--free. Without paying a dime, anyone with access to a web browser can sign up for credit monitoring in just minutes.

So the question we were left with was how to proceed. How could we assess competing companies when some of them provide services at zero cost? After further digging, though, we realized that free does not necessarily mean better. At least, not where credit monitoring is concerned. Now, free food samples when shopping for groceries is another thing altogether. But hey, let’s stay on track here!

Every consumer has different needs that require different services. The variety in credit monitoring plans is a testament to that. Whether you’re looking for just the basics or your needs require a more sophisticated approach, chances are there’s a monitoring service that will suit you.

Good thing there are key points consumers can look into in order to find a service that meets their standards. We urge you to research and take all information with a grain of salt. The truth is everyone’s out to sell you something, even if their service is free. That said, you don’t have to suspend your belief that free is better, just be willing to consider the opposite.

Price & Billing

All of the companies we researched offer free or paid services. Some even offer both. Without exception, all paid services charge consumers on a monthly basis. Pricing ranges from zero to upwards of $30 a month. The lowest monthly fee we encountered was $8.95 for an individual credit monitoring plan, as opposed to a family one.

How Much is Monitored?

All the plans we looked into offer varying degrees of monitoring, ranging from basic to premium. With some services, you’ll probably receive notifications faster than a buttered-up bullet train if anyone so much as thinks about looking into your credit. With other plans, you’ll get a friendly nudge at the end of the month. Again, it’s all about your particular needs. If you’ve ever been a victim of fraud, you might want to throw a wide net just to be safe. If you just want to add another layer of protection to your finances, going basic could fit you well.

Some may deny it, but we all have that friend who still uses an AOL email and swears they’ll never change. While old school methods can sometimes be commendable when it comes to your credit you need to be aware of the latest safety trends. In an age where most people carry small computers (aka smartphones) in their pockets, this is the new normal.

Dark Web Scanning

The dark web is essentially a marketplace that caters to criminals who want to buy and sell stolen goods. To gain access you need special software due to its being part of the deep web, which is cyberspace not indexed by search engines. A lot of what is sold is data that’s been stolen either through large-scale hacks or through one-off situations where a bad actor got ahold of account information and wants to make a profit.

Social Security numbers can be sold for as little as $1. Furthermore, criminals can buy credit card information in bulk. If it’s part of a data breach that has yet to be reported in the press, the price goes up. Also, if there is less available supply for cybercriminals, prices go up.

So why don’t authorities shut the dark web down? The answer is simple: They can’t.

We spoke to investigator and former FBI agent, R.L. Walters about the difficulties law enforcement faces in regard to the dark web:

“It’s kind of like whack-a-mole. You whack one and five more are going to pop up. There is too much money to be made and criminals are going to be drawn to it. There’s very little downside for a criminal, especially if they’re in a country where they’re not worried about getting caught."

Investigator and dark web expert, R.L. Walters. Photo courtesy of himself.

Some credit monitoring companies offer dark web scanning to see if your personal identifying information is among that up for sale. While dark web scanning can seem like a good benefit, Susan Grant warns that it’s not as simple as it sounds. Ms. Grant is Director of Consumer Protection and Privacy at the Consumer Federation of America.

“A lot of people assume that if they have dark web monitoring it means that the service can somehow remove your personal information from the dark web if they find it for sale there, or keep somebody from using it if they buy it,” she said. “Neither of those things are true. And yet, a third of the people we surveyed thought they were true.”

Tools, Support & Security

Let’s say you signed up with a credit monitoring service and everything’s set with your new best friends. So, what toys have they brought to play with?

Well, some plans offer 24/7 credit monitoring at all three credit reporting agencies: Equifax, Experian, and TransUnion. What this means is you’ll be notified if there are any changes in your credit files. Sometimes, sudden and unexpected changes can be an indication of fraud. Whether or not that’s the case, you will be informed via phone call, text message, email, and/or mobile app. Like we said, broad service has its cost, but it provides various ways of detecting suspicious activity.

Other services include round-the-clock customer support, so consumers can reach out and consult over the phone if necessary. Some throw in ID theft insurance to help you recover in case the worst should happen. With numbers as high as $1 million being thrown around, we’d advise you to read the fine print before you get too excited.

Seeing as there will likely be differences in the information reported across the three credit bureaus, please allow us to offer a cautionary piece of advice. Three bureaus see better than one. If somebody applies for credit in your name and the retailer is only using one of the three credit reporting agencies when they pull credit, that inquiry is not going to show up on the other two. So sure, two out of three ain’t bad, but three out of three is a safe bet.

And lastly, security. Watch out for red flags--anything from grandiose claims that can’t be backed up, to an overabundance of negative reviews. If something doesn’t smell right, don’t sign up. And please, make sure any company that will have access to your personal information has not been hit with a security breach. More on that later.

Helpful information about Credit Monitoring

Credit Monitoring? Please Explain

Credit counseling, credit repair, credit insurance, credit monitoring… There is no shortage of services related to credit. For this reason, many similar-sounding and overlapping products in the industry may confuse the average consumer.

So, credit monitoring — here we go.

Essentially, credit monitoring is a service that keeps an eye on your credit score and alerts you to actions that may be considered suspicious. At its core, the service doesn’t provide protection against having your personal information stolen and misused, but it does warn you about such unfortunate events. Certain patterns, indicators, and unusual transactions may be signs of fraud and the sooner you’re aware of them, the better your chances of rectifying the situation. If someone commits fraud using one of your credit cards or takes out a loan using your Social Security number, it may have a negative impact on your credit score.

Whereas credit repair strives to improve your score and remove negative items from your report, credit monitoring is designed to save you trouble by surveilling your finances. Something unusual pops up and you’ll find out. How fast? Well, that all depends on your plan. Upon realizing that you’ve been a victim of fraud or theft, the first immediate step to take is to contact one of the credit reporting agencies and placing a fraud alert with them to minimize the potential damage.

Now, we all make mistakes. Remember Shaquille O’Neal’s 1993 rap album? But you don’t want to make mistakes when it comes to your sensitive personal information. Knowing when and where to disclose this information is of utmost importance. The second someone else appropriates your information, you may become a victim of credit fraud or identity theft.

Data: FTC Consumer Sentinel Network Data Book 2018

Who Needs Credit Monitoring?

Credit monitoring packages provide a wide range of attractive-sounding benefits--but do you really need them? Most of the advertising for the credit monitoring industry tries to appeal to your fears, pointing out everyone and their dog is liable to have their identity stolen and their finances thrown into disarray. Read some of these sites and you’ll find they want to scare you into employing their services. We’re going to look beyond the landing pages and dive in a little deeper.

Truth be told, credit monitoring isn’t for everyone. Nevertheless, it is a practical service created to save you time, place invaluable resources within your reach, and expose you to information you probably wouldn’t have otherwise.

Yes, credit monitoring is usually sought out by consumers who have been victims of identity theft and are hoping to avoid another incident. However, consumers can also reap the benefits of having an extra pair of eyes on their finances. In the last two decades or so, people’s credit histories have become more important than ever. Nowadays they are used not just by credit card companies and mortgage bankers to determine whether to give you a loan--they are used by potential employers, prospective landlords, and even would-be romantic partners. Without credit monitoring, you will have no real-time way of knowing what those prospective creditors are seeing--and you may never know why you’re being ghosted after two dates.

Other people pay close attention to their credit histories and credit scores because they’re trying hard to rebuild their credit ratings. Take it from us, that can be a slow and laborious process. Monitoring your credit history and credit scores can show you what progress you’re making and help teach you what kind of behaviors increase and decrease your creditworthiness.

As Bruce McClary, Vice President of Communications at the National Foundation for Credit Counseling, puts it:

“Peace of mind is important. I mean, obviously, you don’t want to be worried about what could possibly happen that you’re not aware of. So if you need peace of mind, information is often the best way to find relief, and access to that information on a regular basis can help ease your concerns because you are able to see what’s happening on your credit file. So, for that reason, I think just in terms of stress relief it is important to keep your eye on your credit and account activity as much as possible.”

Bruce McClary, VP of Communications at the National Foundation for Credit Counseling

How to Sign Up

With your Social Security number at hand, you can sign up for credit monitoring in a matter of minutes. Please, exercise caution! Handing over those precious digits to any website may expose you to bad actors. We live in an age that’s oversaturated with data, so try hard to only give your Social Security number to reputable websites.

What Makes a Good Provider?

A great credit monitoring provider, whether it’s free or a paid service, will provide you with regular access to your credit report and scores. If they have a good system in place, they’ll be able to alert you fairly quickly about any suspicious activity they’ve detected. Anything from a sudden postal address change to a loan application could be considered suspicious. Alerts can range from a text message or an app notification to an email or even a phone call.

Credit monitoring services keep an eye on one or more of the three credit bureaus. Other benefits may include identity theft protection and dark web scanning. Since the dark web is the digital landscape where most stolen identities are sold, having a provider search for your information on criminal websites is helpful.

In all likelihood, there isn’t one company that will fulfill all your needs but perhaps they’ll come close. One of them could give you frequent access to your credit report, but their customer service is as warm as Chicago in January. Or another may provide all sorts of perks, but only look at one of three bureaus. Perfection in finance is as rare as correctly inserting a USB drive on your first attempt.

We asked Bruce McClary what separates a good provider from a bad one:

Good News for Active Duty Military Personnel

Effective July 31st, 2019, active duty military consumers are eligible for free credit monitoring provided by nationwide consumer reporting agencies. The new law provides that “credit reporting agencies--Equifax, Experian, and TransUnion--must provide free electronic credit monitoring services to active duty servicemembers serving away from their usual duty station and to National Guard members.”

What Does Credit Monitoring Tell You?

Data Breaches

Most good credit monitoring companies will alert you to data breaches that may have compromised your personal information. Data breaches are unauthorized releases of confidential and sensitive consumer information and represent the biggest hacking events of the 21st century.

In 2017 alone, there were 1,579 data breaches exposing nearly 179 million records. That represents a 44% increase in the number of breaches and a 389% increase in records exposed. To put it into perspective, data breaches are happening on a nearly daily basis. Some of these breaches have exposed up to three billion consumers’ personal information--in just one incident. As R.L. Walters pointed out, “So many companies save all kinds of information on their customers, but they don’t have the expertise to make sure that hackers don’t get in to steal it. Everything is digital. We’re all paying with credit cards, [using] very little cash. That, by its very nature, requires you to give up some information.”

In other words, since data breaches are happening more frequently and large retailers are having their databases hacked, you ought to be careful about how you handle your sensitive information online. That includes not saving your credit card on retailer websites, even those you trust. The alternative is to manually enter your information for each purchase. Yes, it’s a hassle but that extra effort just might benefit you in the long run. Like taking the stairs instead of the escalator, but without the sore calves.

“That’s the biggest problem with data breaches,” Grant points out, “consumers are at the mercy of the entities to which they trust their personal information.”

Susan Grant, Director of Consumer Protection and Privacy at the Consumer Federation of America

After a major data breach, it’s never entirely clear if your information has fallen into the wrong hands. That’s where credit monitoring comes in. You may not be able to prevent your personal identifying information from being breached, but with the help of credit monitoring, you can begin to take steps in a timely manner to mitigate any potential damage. Read on and find out immediate steps you can take upon being alerted of fraud or theft.

Credit Card Fraud

When it comes to stealing credit card information, methods have changed since the days of carbon copiers. From skimming devices copying your card’s magstripe, to shimmers reading data from the card’s chip, getting ahold of private credit card information has become more sophisticated.

We spoke to Rob Rex, a consumer who had his credit card information stolen. “I know [it happened at a restaurant] because I’d just gotten this card. It was a Saturday. On Tuesday I see a cable bill on my account and an attempt to connect to two PayPal accounts. [This was] before they started bringing the credit card machines to the table. The credit card was out of my sight for two to three minutes, but that was enough.”

Rob Rex had his credit card information stolen

Indeed, restaurants have come under greater scrutiny recently for their role in credit card fraud. At most restaurants, people who want to pay with a credit card give their card to their server, who then takes it to the cashier and returns with the card and a charge slip. During the time the card is out of the cardholder’s sight, account numbers can be copied and electronic information can be downloaded. One victim described how one such instance prompted him to change the way he handles his finances: “After the incident, I wasn’t going to let that happen again. From then on, I always carry cash and avoid using my card when I can.”

Online, credit cards are at greater risk of being compromised. Even with trusted retailers, your information is not entirely safe, according to Bruce McClary: “That credit information has to sit on a server. That means that you put [it] in someone else’s hands to safeguard, but you know very little about the firewall that they have to protect that data. So it’s a giant leap of faith on the part of the consumer.”

Social Security Number Identity Theft

Social Security theft can be the result of a data breach, a misplaced or thrown out paper, or just honest mistakes over the phone speaking with a scammer. Even if your number is compromised, that doesn’t mean there will be immediate action. Cybercriminals sometimes choose to wait before they use a number for any kind of criminal behavior, when the potential victim may be less attentive. A dark web scan will let you know if your number has been put up for sale in online criminal marketplaces.

What can a person do if they have your Social Security number? A lot of things, including setting up a bank account, taking out a loan, filing fraudulent tax returns, among others. A criminal can essentially become you, in a sense, once they have the number in their possession.

Susan Grant told us about her own experience with an attempt to steal her Social Security number: “I’m repeatedly getting calls from someone claiming to be from the Social Security Administration, wanting to confirm my number--which is like the key to your lockbox. People need to be on guard against those kinds of attempts.”

Online Shopping Scams

Online shopping scams usually take the form of fake websites that are replicas of trusted vendors. You may be redirected to these sites after clicking on bogus links in emails or on social media. One giveaway is the http in its address, as opposed to https. Sites that lack that ‘s’ don’t use encryption, therefore they are not to be trusted.

Online shopping scams usually take the form of fake websites that are replicas of trusted vendors. You may be redirected to these sites after clicking on bogus links in emails or on social media. One giveaway is the http in its address, as opposed to https. Sites that lack that ‘s’ don’t use encryption, therefore they are not to be trusted.

The most frequent items involved in shopping scams are clothes, especially during the holiday season. Be cautious of offers that are just too good to be true. Other red flags are questionable payment options such as money orders or wire transfers. We’d recommend using a credit card or PayPal, seeing as both offer purchase protection for buyers.

What to Do If You’re a Victim of Credit Fraud or Identity Theft

Proceed with a clear head and take action immediately. First thing is to get in touch with the companies and/or banks where the fraud took place. Give them all the details concerning your incident. Then contact at least one of the major credit reporting agencies and place a fraud alert. They’re required to inform the other two, so don’t worry about that.

After that, request copies of your reports on Annual Credit Report. Then, if it applies to your particular situation, report your ID theft to the Federal Trade Commission and contact the Social Security Administration and report any unauthorized use of your number.

More detailed information is available at IdentityTheft.gov, the federal government’s resource for identity theft victims.

Other Threats

Targeted Groups

Our research has shown that two segments of the population tend to be targeted above all others: The elderly and active-duty members of the military. And yet, identity theft tends to be a random crime, meaning anyone can be affected.

Where the elderly are concerned, it’s understandable to a certain extent because some of these folks have paid off their debts, allowing them more liquidity than their younger counterparts. This availability of resources makes them an easy target for bad actors bent on cheating people out of their money. Also, some older people may not be as technologically savvy as younger folks, making them unaware of the latest methods of fraud and theft. Most of these scams are done over the phone.

On the other hand, military personnel regularly have to disclose their Social Security numbers for basic serviceperson errands, from identifying themselves over the phone, to filling out insurance claims. They face particular challenges where their finances are concerned, especially considering that most security clearance background checks look into credit. Scam alerts provided by the military are updated regularly to safeguard active personnel from faceless cheaters.

We asked experts about these recurring attacks on both the elderly and the military. Here’s what they had to say:

Susan Grant: “Service members are more vulnerable because they move around a lot and may be deployed overseas. It may take them longer to discover their identity has been stolen and do something about it, and that enables identity thieves to use their information for longer. Similarly, older people who are targets of a lot of scams may be more likely to give their personal information.”

Bruce McClary: “I think, whether it’s someone who’s elderly or an active-duty servicemember, or whether it’s a young consumer who’s opening up credit for the first time and is beginning to use that in different environments including online--I think in all those situations vigilance is key for protection.”

Tips to Minimize Risk of Identity Theft

There are no guarantees when it comes to identity theft. As Susan Grant pointed out, “Nobody can claim [that you won’t be a victim]. If you hear that, you should report the company to the FTC because it’s not true. Most identity theft services, the main feature is to alert you--after the fact--that your information may have been compromised and help you take whatever steps would be appropriate to minimize the potential fallout.”

Consumers can take the following steps to reduce their exposure:

- Be discreet when saying your Social Security number in public

- Ask if a third party really needs the information they’re requesting

- Avoid clicking on strange links in emails or websites

- Don’t confirm any identity information over the phone

- Hang up on callers that cannot be verified

- Use strong passwords

- Don’t use the same password for all your accounts

- Check your bank and credit accounts regularly

- Don’t access sensitive information when using public Wi-Fi connections

- Limit the amount of personal information shared via social media

- Try to avoid paying bills through the mail, but if you must, don’t leave them in a mailbox outside your home

One can never be too careful when limiting who and what has access to your personal information. “I would say that an ounce of prevention is worth a pound of cure,” McClary told us, “So anything that you can do to safeguard your personal information, do it. Whether it’s being aware of your surroundings when you’re using your credit card or pin number or being careful of the websites where you’re making online purchases.”

Furthermore, social media has become a big liability for some consumers who post information that can be used against them in an effort to commit fraud. A social media platform like Twitter has nearly 70 million active monthly users in the United States, all sharing information, photos, and locations. In essence, there’s plenty of over sharing.

As R.L. Walters points out, “Consumers tend to put too much information out there. People put so much on their social media that makes it really easy on a criminal to have [what] they’d need to steal your identity or come up with a different identity that uses your information.”

Credit Monitoring vs. Identity Theft Protection

So, What’s the Difference?

Credit monitoring is a beneficial service, but with certain limitations. It will alert you if suspicious activity shows up on your credit reports, but it will neither prevent your personal information from being stolen nor help clean up the damage caused by identity thieves. By contrast, identity theft protection is designed to prevent malicious acts from even happening. For instance, your Social Security number can be used by a third party in ways that will not show up on your credit reports; an identity theft protection service would pick up on that sort of activity.

Credit monitoring is a beneficial service, but with certain limitations. It will alert you if suspicious activity shows up on your credit reports, but it will neither prevent your personal information from being stolen nor help clean up the damage caused by identity thieves. By contrast, identity theft protection is designed to prevent malicious acts from even happening. For instance, your Social Security number can be used by a third party in ways that will not show up on your credit reports; an identity theft protection service would pick up on that sort of activity.

There isn’t always a bright line between a “credit monitoring company” and an “identity theft protection company.” For example, some credit monitoring companies offer identity restoration in the event of theft. Others even reimburse consumers for any financial losses they may have incurred as a result.

For more information, check out our Best Identity Theft Protection Based on In-Depth Reviews.

The One You Need

Telling you which of these two services is better for you is a hard one. Since free credit monitoring services are widely available, it wouldn’t hurt to try one of them out, assuming they appear to be trustworthy entities. You can relax a bit knowing that someone is keeping an eye on any applications for credit done in your name, payment history, among others. And if you decide you like the information that free services provide, you might then consider signing up for a paid plan that offers additional benefits.

Identity theft protection may be a wise choice for someone who’s already been a victim and would like to avoid a repeat performance. Consumers in this situation may also opt to freeze their credit, restricting access to their report and hindering any theft attempt. Susan Grant told us that credit freezes are “probably the most effective thing you can do as a prophylactic. It will foil attempts to open most kinds of new accounts in your name. Not all of them, because not all creditors check credit reports.”

The Do-It-Yourself Approach

Another alternative is DIY. Taking matters into your own hands may be difficult, but not impossible. It’s like washing a car. Sure, the pros are going to do an outstanding job, but your own effort won’t be in vain.

The first chore you’ll want to tackle is keeping a close eye on your credit statements as often as possible and look for any signs of suspicious activity. See something you don’t recognize? Get on the phone with your bank or credit card provider and demand answers.

Second, use annualcreditreport.com and pull your credit report from each of the three major credit reporting agencies once every 12 months. That’s a no-cost service that gives you full access to the details on your credit report. Some consumers even request one report from each bureau every four months in order to have year-round monitoring. If you decide to spread out the reports, you wouldn’t be the first, but it’s a fact that some items will only appear on one or two of the reports, as opposed to all three. Some banks, insurance companies, and even employers offer free credit monitoring services. So look into it--perhaps you already have a service and are not aware of it.

When going for the do-it-yourself approach, it can be difficult to keep track of everything. Just keep in mind that some plans offer free trials, while others offer credit monitoring services free of charge.

What to Expect Going Forward with a Credit Monitoring Service

Things to Consider Beforehand

A credit monitoring service is simply a tool that consumers can use where they have someone else keeping an eye on their credit activity. These services will typically watch the activity on each of the three major credit reporting agencies to make sure you know what’s being added to your credit file. You receive alerts to make sure you’re aware in the moment of any account activity that may be taking place.

As the customer, you have the option to set up different alert systems that may provide you with warnings of suspicious activity. This will allow you to take action quickly if there’s something that needs to be addressed right away.

So consider all your financial needs. Keep them in mind to avoid paying for services you may not need. Read the fine print, know the cancellation policy, and put in the time to research a company and make sure they’re trustworthy. Ultimately, what will determine the kind of credit monitoring service you want is how extensive you want/need it to be and how much you’re willing to pay for it.

Oh, the Costs. Are They Worth It? Is Free Monitoring Enough?

That depends on your budget, of course. Also, personal preference and comfort level come into play when considering the amount of access to information, the frequency of the alerts, among others. Some consumers may feel more comfortable with a paid service that offers more features that will tend to their specific needs. Access to information from all three credit bureaus is something else to consider.

Some free services only extend their monitoring to one bureau. But, it’s free! You will save anywhere between $100 and $200 a year, while still receiving a service from a (hopefully) reputable company.

We asked Walters about paid monitoring services: “I think the ones that have a cost have a few more protections built in,” he said. “A little more bells and whistles. Some do a good job at an affordable monthly cost. I think, based on what I’ve seen, it’s plausibly worth it.”

Susan Grant is skeptical about free services, indicating that nothing is really for free:

Is Credit Monitoring an Essential Service?

The short answer is maybe. Long answer… Keep in mind that credit monitoring is not a preventive service. Yes, you will be alerted of suspicious activity. But that’s after the fact. The service can be helpful in alerting you more quickly than you might otherwise find out about somebody opening a new account in your name. And yet, it will not alert you to all different kinds of identity theft that may have been committed with your personal information.

With plans ranging from basic to premium, there are plenty of options out there. But for broad protection, you need a service that uses all three credit bureaus. Insist on this, in particular, if you’re paying for the service.

In the end, even if you do employ the services of a credit monitoring service, you would be wise to keep an eye on your credit yourself and take measures to secure your personal identifying information. While credit monitoring can provide certain benefits, including peace of mind, having a service should not result in you lowering your guard. Again, there are no guarantees.

FAQs about Credit Monitoring

I’m not a very affluent individual. Do I really need credit monitoring?

Yes, we’re all exposed in one way or another. The simple act of using a credit card, online or otherwise, puts you at risk. The Identity Theft Resource Center (ITRC) has stated that over 14 million credit cards were exposed in 2017. As always, it’s a matter of weighing the pros and cons and making a decision based on your needs.

Also, there are other benefits for credit monitoring that go beyond becoming aware of suspicious activity. You’ll be able to monitor the progress of your credit score if you’re shooting for an increase over time.

Don’t I have credit monitoring already?

The Equifax data breach of 2017 exposed information belonging to 147 million consumers. As part of a settlement, Equifax is required to pay $700 million which include free credit monitoring services to everyone affected by the breach. Adults will receive 10 years of free monitoring. Victims who were minors in May 2017 may qualify for up to 18 years of monitoring. Find out if you’re eligible by signing up for email notifications from the FTC. Also, visit the Equifax page created to keep the public informed about the pending settlement.

Information is still becoming available but as of July 2019, the settlement has yet to be approved by a federal court.

Why should I pay for something I can get for free?

What is the dark web?

What are data breaches and how do they affect my finances?

Is any online company 100% safe?

What information should I protect from potential identity thieves?

-Place of birth

-Home address

-Personal phone number

-Bank statements

-Medical bills

-Tax returns

-Any form of personal identification

I constantly buy stuff online. How can I minimize my exposure?

My identity was just stolen. What now? Help!

Remain calm and take the next steps that apply to your particular situation:

-Get in touch with the companies and banks where the fraud took place-

-Contact at least one of the major credit reporting agencies and place a fraud alert

-Request copies of your credit reports

-Report your ID theft to the Federal Trade Commission

-Contact the Social Security Administration and report any unauthorized use of your number

-Reach out to local law enforcement

For more detailed information, visit IdentityTheft.gov, the federal government’s resource for identity theft victims.